MANDARIN ORIENTAL INTERNATIONAL LIMITED 2024 PRELIMINARY ANNOUNCEMENT OF RESULTS

Highlights. |

|

MANDARIN ORIENTAL INTERNATIONAL LIMITED 2024 PRELIMINARY ANNOUNCEMENT OF RESULTS

Highlights. |

Catégorie : Monde - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 10-03-2025

Crédit photo © Mandarin Oriental Hotel Group

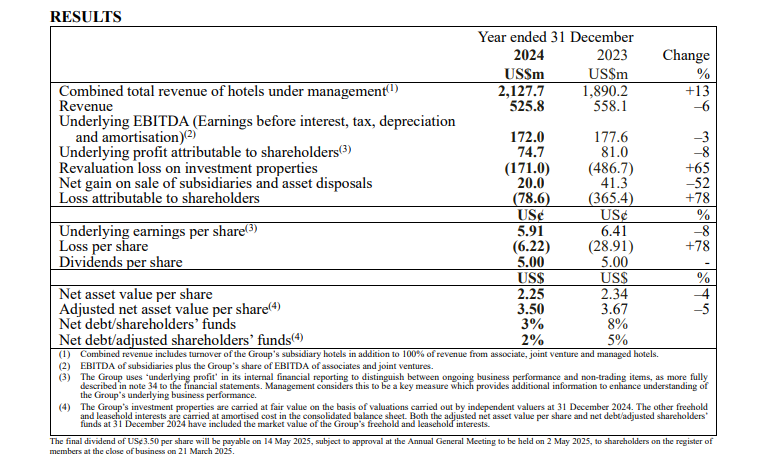

- Underlying profit after tax of US$75 million in 2024, 8% lower than 2023 due to lower one-off residences branding fees

- Accelerated growth with five new hotels and residences planned to open in 2025

- Strong pipeline replenishment with the announcement of eight new management contracts including the latest additions: Hôtel Lutetia in Paris, the Conservatorium Hotel in Amsterdam, Puerto Rico in the Caribbean, and Suzhou in China

- 41 hotels under management, a milestone in global footprint, with a target to more than double by 2033

- Investing in capability now to achieve long-term targets and sustain accelerated growth

- Paris property disposed for US$382 million advancing asset-light strategy

- Final dividend of US¢3.50 per share, resulting in stable total dividends of US¢5.00 per share

“With a new vision and a brand-led, guest-centric strategy, supported by renewed dynamic leadership and effective governance, Mandarin Oriental is well-positioned to enhance further its desirability and deliver accelerated growth as an ultra-luxury hospitality brand, as well as to create value for its shareholders, partners, and communities over the next 10 years.” Ben Keswick Chairman.

Year in preview

2024 was a year of significant progress for Mandarin Oriental, marked by strong growth, robust performance, and the launch of our brand-led, guest-centric strategy, paving the way for accelerated further growth over the next decade.

Global luxury hospitality has transitioned from a period of strong resurgence in travel demand following the lifting of pandemic restrictions to a more normal pace of growth in 2024. Against this backdrop, Mandarin Oriental has reported good performance underpinned by its enduring brand desirability, an expanding market-leading portfolio, and exceptional guest experiences.

In the Management Business, improvements in RevPAR performance were supported by strong guest demand for our ultra-luxury hotels, and drove solid combined total revenue performance across all regions, and considerable growth in hotel management fee income, notably in Asia and Europe, the Middle East and Africa (‘EMEA’).

2024 Financial performance

The Management Business reported an underlying profit after tax of US$34 million in 2024, compared to US$41 million in 2023. Strong growth in recurring hotel management fee income was more than offset by reductions in one-off residences branding fees, but recurring profitability continued to improve as the Management Business scales.

The Owned Hotels reported a stable contribution of US$45 million profit after tax in 2024. The majority of the Group’s Owned Hotels delivered solid revenue and profit growth, with Singapore in particular delivering higher profits after the hotel’s renovation in 2023. Tokyo and Madrid benefitted from robust demand and achieved notable improvements in earnings. Earnings from Paris reduced following the disposal of that hotel property together with its retail units in mid-2024.

Overall, underlying profit after tax was US$75 million in 2024 compared to US$81 million in 2023. Underlying earnings per share was US¢5.91, compared with US¢6.41 in 2023. Non-trading losses of US$153 million primarily comprised a non-cash revaluation of One Causeway Bay – the Group’s redevelopment site in Hong Kong, resulting in a loss attributable to shareholders of US$78 million. Consolidated net debt significantly decreased from US$225 million as at 31 December 2023 to US$94 million as at 31 December 2024, mainly due to the receipt of sale proceeds from Paris hotel and retail properties, partially offset by investment in One Causeway Bay. Gearing was 2% of adjusted shareholders’ funds, reduced from 5% at the end of 2023.

The Directors recommend a final dividend of US¢3.50 per share. Together with the interim dividend of US¢1.50 per share declared, total dividends are US¢5.00 per share.

Sustainability

As we set our sights on accelerated growth over the next 10 years, we believe firmly in increasing our positive social impact and reducing the intensity of our environmental footprint. We set ambitious environmental targets across energy and emissions intensity, the elimination of single-use plastics, responsible sourcing, sustainable design practices and waste reduction.

Governance

In 2024, a number of changes were made to the composition and operation of the Company’s Board and Committees to ensure an effective governance framework that supports the Group’s new strategy as a brand-led, guest-centric, global luxury hospitality group.

Board Composition

We were delighted to welcome three new Independent Non-Executive Directors to the Board: Cristina Diezhandino, Chief Marketing Officer and a member of Diageo’s executive committee, effective 1 August 2024; Fabrice Megarbane, Chief Global Growth Officer and a member of L’Oreal’s executive committee, effective 1 August 2024; and Scott Woroch, Managing Director of Kadenwood Partners, effective 4 November 2024.

With effect from 22 July 2024, John Witt stepped down as a Director of the Company and as a member of the Company’s Remuneration and Nominations Committees.

Board Committees

With effect from 22 July 2024, Adam Keswick stepped down from the Nominations Committee, and Graham Baker stepped down from the Remuneration Committee. Adam remains as a Director.

On 24 July 2024, the Company’s Board approved updated terms of reference for each of the Audit, Remuneration and Nominations Committees, to align them better with the future needs of the business.

Corporate Secretary

On 22 July 2024, Sean Ward was appointed as Corporate Secretary of the Company, succeeding Jonathan Lloyd.

On behalf of the Board, I would like to thank John and Graham for their contributions to the Group, and welcome Cristina, Fabrice, Scott and Sean.

Outlook

Luxury hospitality presents enormous potential for future growth. With dynamic leadership, clarity of vision and strategy, and effective governance, Mandarin Oriental is strategically positioned to enhance further its desirability and scale as an ultra-luxury hospitality brand, and to create value for its shareholders, partners, and communities.

Group chief executive’s review

In 2024, Mandarin Oriental launched its brand-led, guest-centric strategy and reaffirmed its position as a leader in luxury hospitality anchored on our new vision, Fans of the Exceptional, Every Day, Everywhere.

This new vision for Mandarin Oriental encapsulates our relentless commitment to elevating our offering and delivering exceptional experiences wherever we meet guests. In the rapidly evolving world of global hospitality, Mandarin Oriental’s Legendary Service, unique dual Asian heritage, and constant innovation will maintain the brand at the pinnacle of luxury.

We have embarked on our new strategy for the next decade, focused on elevating the desirability of the brand, doubling our portfolio in key global cities and sought-after leisure destinations, innovating the guest experience to make every moment exceptional, as well as generating value for our stakeholders. We have shared this new strategy with our hotel owner partners, and our team of over 15,000 colleagues, who are central to the success of the new vision. The new strategy has been extremely well received, bringing clarity, confidence, and pride to the Group. With this vision, we are now building the right capabilities, governance, and culture to drive transformational growth.

2024 performance

Summary of Performance: double-digit total combined revenue growth

Mandarin Oriental now manages 41 hotels, 12 residences, and 26 homes across 26 markets. In 2024, the Group reported solid operating performance. Combined total revenue for hotels under management was US$2.1 billion for the year, up 13% from 2023. This improvement was fuelled by a 7% increase in RevPAR, as occupancy continued to strengthen across all regions. Food & Beverage (‘F&B’) revenue was also 11% higher than 2023, contributing to the healthy growth in top-line performance.

In Europe, the Middle East and Africa (‘EMEA’), RevPAR was US$671, 4% above the record levels set in 2023. RevPAR performance was notably better in Madrid, Costa Navarino, and Zurich, as well as Riyadh which demonstrated the strength of the brand after being rebranded as a Mandarin Oriental hotel in early 2024.

In America, we demonstrated resilient performance and achieved growth in both rates and occupancy, resulting in a 6% year-on-year improvement in RevPAR to US$434. Page 6 - more - In Asia, RevPAR was US$242, 14% above 2023. Both rates and occupancy were supported by strong intra-regional travel demand, with Tokyo and Southeast Asia performing particularly well. We continued to see strong domestic demand in China. Our most recent launch, our second hotel in Beijing, has commanded strong rate leadership demonstrating the strength and desirability of the brand.

Management Business: +15% in hotel management fee income

With higher RevPARs and an expanded portfolio, we achieved another year of very strong growth in hotel management fee income over previous record levels. The 15% year-on-year improvement in hotel management fee income was primarily driven by Asia and EMEA, while hotels in America showed steady performance. EBITDA from the Management Business was lower in 2024 compared to 2023, as better recurring hotel management fees were offset by reduced one-off branding fees from the sale of branded residences. With growth of branded residences being a high return priority for the Management Business, we continue to replenish our residences pipeline to drive sustainable growth.

Owned Hotels: strong underlying growth

Following the disposal of our property in Paris, the Group owns or partially owns 12 hotels across the globe. In 2024, Owned Hotels recorded 2% higher EBITDA than in 2023. Mandarin Oriental, Tokyo, celebrating its 20th anniversary this year, continued to excel in a competitive market and delivered further revenue and profit growth in 2024. Mandarin Oriental, Singapore returned strong revenues and profits after its repositioning. In Europe, Mandarin Oriental Ritz, Madrid, achieved record EBITDA in 2024, and was acclaimed with the highest distinction of three Michelin keys by The MICHELIN Guide.

|

|