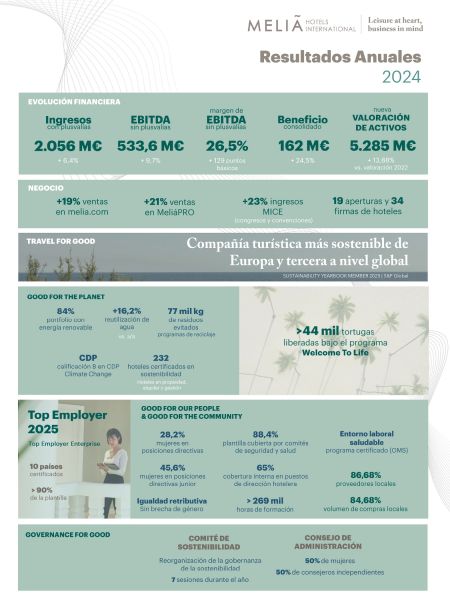

ANNUAL RESULTS 2024 - MELIÁ'S EARNINGS INCREASED BY 24.5% TO €162 MILLION, WITH AN EBITDA (EXCLUDING CAPITAL GAINS) OF €533.6 MILLION, ACHIEVING A NET FINANCIAL DEBT TO EBITDA RATIO OF 2.2 (Espagne)

RevPAR saw qualitative growth, closing the year up 10.7%. |

|

ANNUAL RESULTS 2024 - MELIÁ'S EARNINGS INCREASED BY 24.5% TO €162 MILLION, WITH AN EBITDA (EXCLUDING CAPITAL GAINS) OF €533.6 MILLION, ACHIEVING A NET FINANCIAL DEBT TO EBITDA RATIO OF 2.2 (Espagne)

RevPAR saw qualitative growth, closing the year up 10.7%. |

Catégorie : Europe - Espagne - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 03-03-2025

Crédit photo © Meliá Hotels International

- Net Debt was reduced by more than one-third (- €391 million) to €772.7 million

- EBITDA margin, excluding capital gains, improved by 129 basis points

- The Group's owned assets were revalued by 13.88% to €5,285 million

- The portfolio expanded with the signing of 34 new hotels and the opening of 19 establishments

Main highlights of 2024

Business evolution:

∙ Global RevPAR increased by 10.7% compared to 2023, with 75% of the growth attributable to price improvements.

∙ Group revenue, excluding capital gains, rose by 4.4% to €2,013 million, confirming a trend towards healthy growth

normalization.

∙ EBITDA, excluding capital gains, reached €533.6 million, 9.7% higher than in 2023, with an EBITDA margin of 26.5%

(+129 basis points).

∙ Melia.com and other own channels now account for 50% of centralized sales, with MeliaPro, the B2B sales platform,

showing a 21% increase over the previous year.

∙ Meliá signed 34 new hotels in 2024, all under asset-light formulas, adding over 5,000 rooms, and opened another

19 hotels (all under management agreements except for one lease), adding approximately 3,000 rooms. As of

today, the pipeline includes 72 hotels with more than 13,000 rooms.

Financial management:

∙ CB Richard Ellis' valuation of the Group's assets as of December 31, 2024, amounts to €5,285 million, an increase

of 13.88% compared to 2022.

∙ Pre-IFRS16 Net Financial Debt decreased by €391 million to €772.7 million, thanks to operating cash generation

(approximately €100 million) and asset rotation transactions totaling €300 million net.

∙ The Company met its target, achieving a Net Financial Debt/EBITDA ratio of 2.2x, returning to pre-pandemic levels.

Responsible managament (ESG):

∙ In 2025, Meliá was once again recognized as the most sustainable hotel company in Europe by Standard & Poor's

Global, and third in the entire global tourism sector.

∙ In the area of people and workforce, Meliá renewed its ‘Top Employer’ certification, now covering 10 countries and

representing 90% of its workforce. The company also achieved recognition as a Top Employer Regional in Europe

and North America, and as a ‘Top Employer Enterprise’, positioning it among the best companies to work for

globally.

∙ The Company reports progress in sustainability governance, including a new indicator control system and

advances in compliance with the European CSRD Directive.

∙ In the environmental area, Gran Meliá Villa Le Blanc ended the year as the Group's first hotel with net-zero

emissions.

Outlook 2025

∙ 2025 has begun with promising prospects, confirming strong demand and a normalization in the pace of growth.

∙ The holiday segment saw positive performance in the Canary Islands, Cape Verde, and the Caribbean, while

European capitals performed well in the urban segment during the first quarter.

∙ Bookings showed solid growth, with a high single-digit increase across all segments compared to the previous

year.

∙ The Black Friday campaign, with a 26% increase in sales and a 5% rise in average rate, provided a strong start to

the year.

∙ The MICE segment recorded a 16% increase in confirmed bookings for 2025 compared to the same date last

year.

∙ Based on current visibility, the Company expects a mid-single-digit increase in RevPAR by 2025.

∙ Meliá expects to sign between 25 and 30 new hotels and will open at least 20 hotels, approximately one every

two weeks.

Gabriel Escarrer, Chairman & CEO:

“2024 has been a positive year for our Company, marking the completion of our recovery from the disruption caused by the pandemic, fulfilling the commitments we made at the start of the year regarding business improvement and financial consolidation, and surpassing prepandemic revenue and profit levels. It has been a year in which the tourism industry has entered a new phase of normalized prosperity. The initial surge in demand following the biggest crisis in the history of tourism—driven by 'revenge' for the restrictions we all experienced—has now transitioned into steady growth within a more stable environment, where we feel confident in continuing to optimize our management and create value.

For Meliá Hotels International, much of this success is owed to our post-Covid strategy, which has allowed us to capitalize on the dynamic travel demand, strengthen our balance sheet, grow, and enhance the value and category of our hotel portfolio (which now totals €5.285 billion in the latest valuation). At the same time, we have reaffirmed our commitments and maintained our leadership in sustainability within the tourism industry. This strategy has allowed us to move toward a model of a larger, more efficient, and sustainable Company—one that is more resilient to the challenges of today’s environment. Our 2024 results reflect this progress, and I am proud to present them to all our stakeholders today."

Meliá Hotels International's 2024 results reflect the consolidation of the general growth trend in the industry, with a healthy return to normalization after two years of accelerated growth. For Meliá, this trend translated into a 4.4% increase in revenue excluding capital gains (€2,013 million) and a 10.7% improvement in Average Revenue Per Available Room (RevPAR), 75% of which was attributed to the improvement in the average rate during the year, while occupancy levels remained slightly below those recorded in 2019, leaving room for further growth.

The Group’s EBITDA also surpassed expectations, reaching €575.4 million (€533.6 million excluding capital gains), and consolidated profit (€162 million) improved by 24.5% compared to 2023. The Company also enhanced its EBITDA margin to 26.5% (+129 basis points) thanks to improvements in average rates, efficiency, and cost control, while also boosting customer satisfaction. The Group achieved an excellent average Net Promoter Score (NPS) of 59 across its entire hotel portfolio, nearly 6 points higher than the previous year's score of 53. NPS improvements were recorded across all brands, with a significant increase of 10 points for the Paradisus by Meliá brand, which made a major contribution to this outstanding satisfaction result, exceeding the industry average.

On the financial front, Meliá successfully reduced its Net Financial Debt by nearly one-third (- €391 million), bringing it to €772.7 million. This achievement was driven by two asset rotation operations with a net value of approximately €300 million, and particularly by the generation of around €100 million in cash—after paying €21 million in dividends. As a result, the Group reached its goal of positioning its Net Debt/EBITDA ratio at 2.2x, a level similar to pre-Covid figures.

Meliá's strategy to build a more resilient and profitable business has relied on several levers to ensure sustainable and qualitative growth. These include expansion into both traditional destinations and emerging markets such as Albania, Saudi Arabia, and the Indian Ocean, as well as a focus on the luxury segment, where premium and luxury brands now represent 64% of the portfolio and 80% of the pipeline.

Additionally, revenue maximization is supported by direct channels like Melia.com and the revamped Meliá App, which now account for 50% of total centralized sales. This allows for the increased personalization demanded by the market, leading to higher revenue per customer and improved satisfaction and loyalty indices.

The personalization strategy is further reinforced by the MeliáRewards Loyalty Programme, with over 17 million members contributing 85% of the revenue from direct channels, and Club Meliá, with more than 30,000 members.

Villa Le Corail Gran Meliá Poolside Cabannas

Crédit photo © Meliá Hotels International

|

|