MARRIOTT INTERNATIONAL REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS

Marriott International Q4 2024 Highlights. |

|

MARRIOTT INTERNATIONAL REPORTS FOURTH QUARTER AND FULL YEAR 2024 RESULTS

Marriott International Q4 2024 Highlights. |

Catégorie : Monde - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 12-02-2025

Crédit photo © Marriott International

- Fourth quarter reported diluted EPS totaled $1.63 and adjusted diluted EPS totaled $2.45

- Fourth quarter reported net income totaled $455 million and adjusted net income totaled $686 million

- Fourth quarter adjusted EBITDA totaled $1,286 million

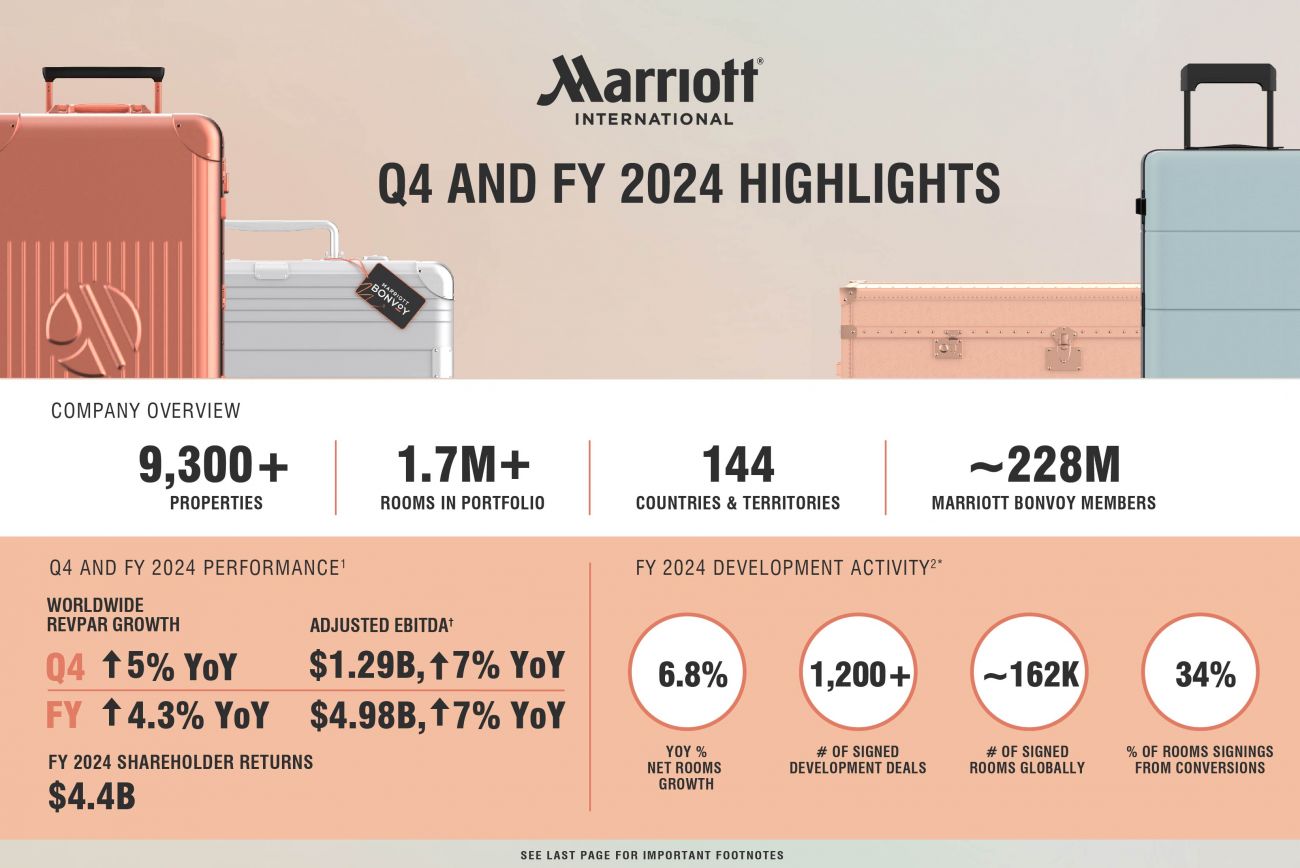

- With record gross room additions of over 123,000 in 2024, net rooms grew 6.8 percent from year-end 2023

- At the end of the year, Marriott’s worldwide development pipeline totaled nearly 3,800 properties and over 577,000 rooms

- The company returned over $4.4 billion to shareholders through dividends and share repurchases in 2024Marriott International, Inc. (Nasdaq: MAR) today reported fourth quarter and full year 2024 results.

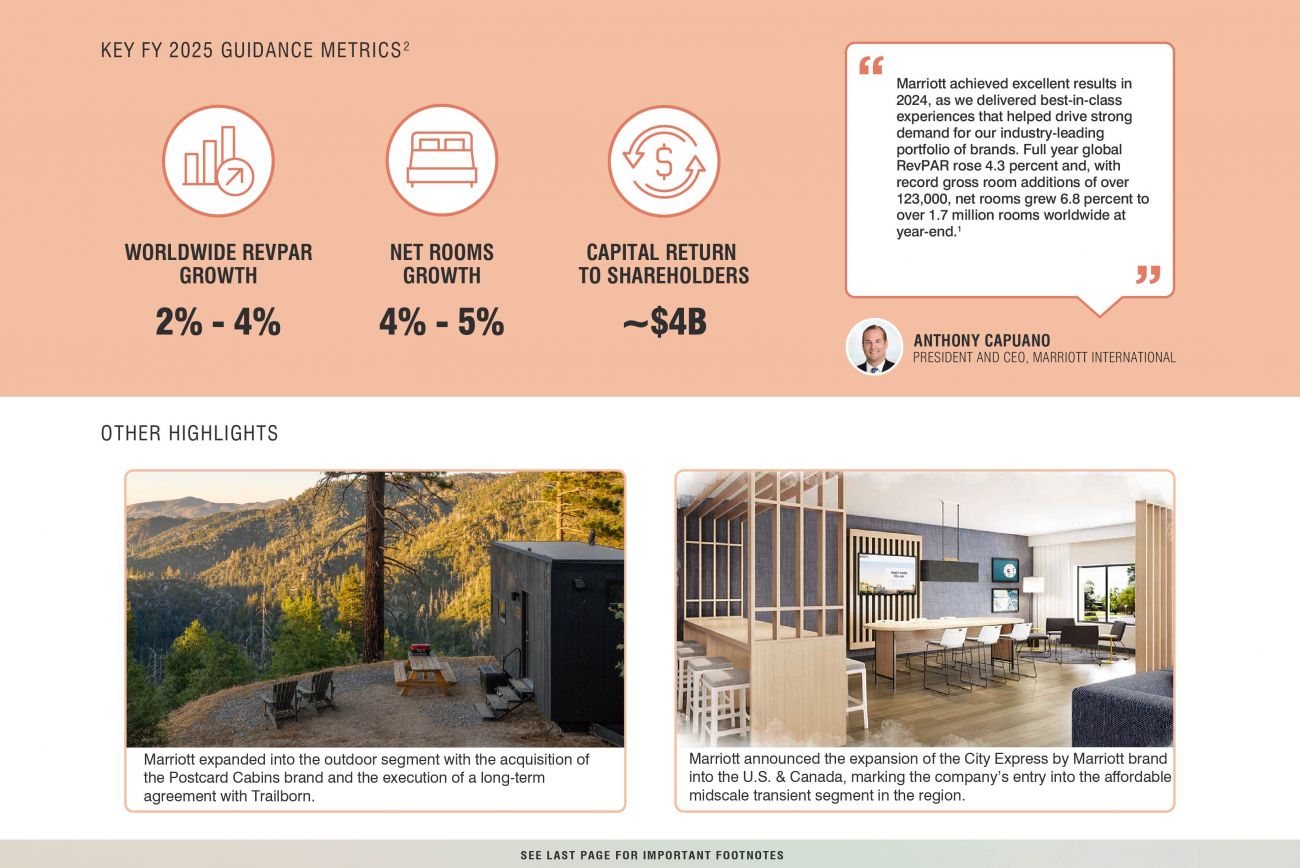

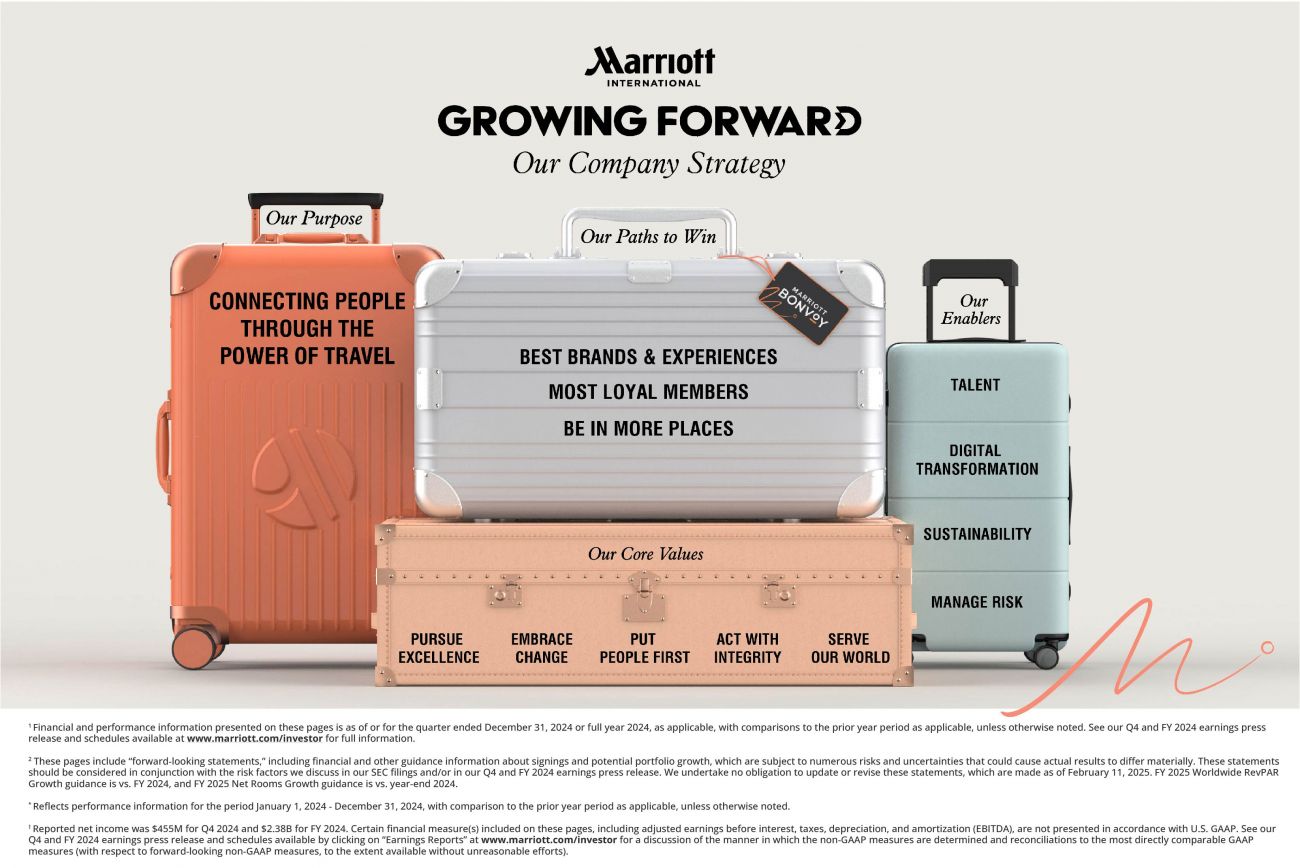

Anthony Capuano, President and Chief Executive Officer, said, “Marriott achieved excellent results in 2024, as we delivered best-in-class experiences that helped drive strong demand for our industry-leading portfolio of brands. Full year global RevPAR rose 4.3 percent and, with record gross room additions of over 123,000, net rooms grew 6.8 percent to over 1.7 million rooms worldwide at year-end.

“In the fourth quarter, worldwide RevPAR rose 5 percent, driven by gains in both ADR and occupancy. International RevPAR increased by more than 7 percent, with APEC and EMEA leading the way and benefiting from strong leisure demand. RevPAR in the U.S. & Canada rose more than 4 percent, the region’s highest RevPAR increase of the year, with all customer segments growing versus the prior-year quarter.

“2024 was a terrific year for our development team. The company signed a record number of new deals, and our industry-leading development pipeline reached over 577,000 rooms at the end of the year. For the full year, conversions represented more than one-third of our rooms signings and over half of our room additions.

“We continued to enhance our portfolio to deliver new travel experiences to our guests around the world. We advanced our presence in the midscale segment with the opening of 28 Four Points Flex hotels across EMEA and APEC and the debut of the City Express by Marriott brand in the U.S. & Canada. We also strengthened our non-traditional offerings with founding deals in the outdoor lodging segment with key players Postcard Cabins and Trailborn.

“Looking ahead, I am incredibly optimistic about Marriott’s future. With our unparalleled global rooms distribution and brand portfolio, leading loyalty program with nearly 228 million Marriott Bonvoy members and our dedicated associates, I believe Marriott is well-positioned to take advantage of the continued momentum in travel. With our powerful, cash-generating asset-light business model, we look forward to delivering strong, valuable growth as we continue to connect people around the world through the power of travel.”Fourth Quarter 2024 ResultsBase management and franchise fees totaled $1,128 million in the 2024 fourth quarter, a 10 percent increase compared to base management and franchise fees of $1,026 million in the year-ago quarter. The increase is primarily attributable to RevPAR increases and unit growth, as well as higher residential and co-branded credit card fees.

Incentive management fees totaled $206 million in the 2024 fourth quarter, compared to $218 million in the 2023 fourth quarter, with growth in APEC offset by declines in U.S. & Canada and Greater China.

Owned, leased, and other revenue, net of direct expenses, totaled $100 million in the 2024 fourth quarter, compared to $151 million in the 2023 fourth quarter. The decrease was primarily driven by a $63 million termination fee related to a development project in the year-ago quarter.

General, administrative, and other expenses for the 2024 fourth quarter totaled $289 million, compared to $330 million in the year-ago quarter. The year-over-year decline largely reflects lower administrative, bad debt and litigation expenses.

Interest expense, net, totaled $170 million in the 2024 fourth quarter, compared to $144 million in the year-ago quarter. The increase was largely due to higher interest expense associated with higher debt balances.

In the 2024 fourth quarter, the provision for income taxes totaled a $143 million expense compared to a $267 million benefit in the 2023 fourth quarter. The unfavorable year-over-year change is primarily due to 2023 fourth quarter international intellectual property transactions resulting in $228 million of benefits and a $223 million release of a tax valuation allowance in the year-ago quarter.

Marriott’s reported operating income totaled $752 million in the 2024 fourth quarter, compared to 2023 fourth quarter reported operating income of $718 million. Reported net income totaled $455 million in the 2024 fourth quarter, compared to 2023 fourth quarter reported net income of $848 million. Reported diluted earnings per share (EPS) totaled $1.63 in the quarter, compared to reported diluted EPS of $2.87 in the year-ago quarter.

Adjusted operating income in the 2024 fourth quarter totaled $1,072 million, compared to 2023 fourth quarter adjusted operating income of $992 million. Fourth quarter 2024 adjusted net income totaled $686 million, compared to 2023 fourth quarter adjusted net income of $1,055 million. Adjusted diluted EPS in the 2024 fourth quarter totaled $2.45, compared to adjusted diluted EPS of $3.57 in the year-ago quarter.

Adjusted results excluded cost reimbursement revenue, reimbursed expenses, restructuring and merger-related charges and gain on asset dispositions. See the press release schedules for the calculation of adjusted results and the manner in which the adjusted measures are determined in this press release.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled $1,286 million in the 2024 fourth quarter, a 7 percent increase compared to fourth quarter 2023 adjusted EBITDA of $1,197 million. See the press release schedules for the adjusted EBITDA calculation.Full Year 2024 EPS ResultsFull year 2024 reported diluted EPS totaled $8.33, compared to reported diluted EPS of $10.18 in 2023. Full year 2024 adjusted diluted EPS totaled $9.33, compared to adjusted diluted EPS of $9.99 in 2023. Reported and adjusted results in 2024 included a $19 million ($14 million after-tax and $0.05 per share) guarantee reserve for a U.S. hotel, which was negotiated in connection with the Starwood acquisition. Reported and adjusted results in 2023 included a $63 million ($47 million after‐tax and $0.15 per share) termination fee related to a development project, $228 million ($0.75 per share) of tax benefits from international intellectual property transactions and a $223 million ($0.73 per share) favorable impact from the release of a tax valuation allowance.Selected Performance InformationNet rooms grew 6.8 percent from year-end 2023, as the company added roughly 109,000 net rooms globally during 2024, including more than 45,000 net rooms in international markets. At the end of the year, Marriott’s global system totaled over 9,300 properties, with roughly 1,706,000 rooms.

At the end of the year, the company’s worldwide development pipeline totaled 3,766 properties with over 577,000 rooms, including 175 properties with roughly 29,000 rooms approved for development, but not yet subject to signed contracts. The year-end pipeline included 1,381 properties with over 229,000 rooms under construction, including hotels that are in the process of converting to our system. Fifty-five percent of rooms in the year-end pipeline are in international markets.

In the 2024 fourth quarter, worldwide RevPAR increased 5.0 percent (a 5.0 percent increase using actual dollars) compared to the 2023 fourth quarter. RevPAR in the U.S. & Canada increased 4.1 percent (a 4.0 percent increase using actual dollars), and RevPAR in international markets increased 7.2 percent (a 7.1 percent increase using actual dollars).Balance Sheet & Common StockAt year-end 2024, Marriott’s total debt was $14.4 billion and cash and equivalents totaled $0.4 billion, compared to $11.9 billion in debt and $0.3 billion of cash and equivalents at year-end 2023.

The company repurchased 2.0 million shares of common stock in the 2024 fourth quarter for $0.5 billion. For full year 2024, Marriott repurchased 15.4 million shares for $3.7 billion. Year to date through February 7, the company has repurchased 1.2 million shares for $350 million.Company Outlook 1See the press release schedules for the adjusted EBITDA calculations. 1See the press release schedules for the adjusted EBITDA calculations.

2Adjusted EBITDA and Adjusted EPS – diluted for first quarter and full year 2025 do not include cost reimbursement revenue, reimbursed expenses, restructuring and merger-related charges, or any potential asset sales or property or brand acquisitions that may occur during the year, each of which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant.

3Assumes the level of capital return to shareholders noted above.

4Includes capital and technology expenditures, loan advances, contract acquisition costs, and other investing activities, but excludes any potential property or brand acquisitions, which we cannot forecast with sufficient accuracy and which may be significant.

5Assumes the level and types of investment spending noted above and that no asset sales or property or brand acquisitions occur during the year.

Marriott International, Inc. (Nasdaq: MAR) will conduct its quarterly earnings review for the investment community and news media on Tuesday, February 11, 2025, at 8:30 a.m. Eastern Time (ET). The conference call will be webcast simultaneously via Marriott’s investor relations website at www.marriott.com/investor, click on “Events & Presentations” and click on the quarterly conference call link. A replay will be available at that same website until February 11, 2026.

The telephone dial-in number for the conference call is US Toll Free: 800-274-8461, or Global: +1 203-518-9814. The conference ID is MAR4Q24. A telephone replay of the conference call will be available from 1:00 p.m. ET, Tuesday, February 11, 2025, until 8:00 p.m. ET, Tuesday, February 18, 2025. To access the replay, call US Toll Free: 800-753-0348 or Global: +1 402-220-2672 using conference ID MAR4Q24.

1All occupancy, Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) statistics and estimates are systemwide constant dollar. Unless otherwise stated, all changes refer to year-over-year changes for the comparable period. Occupancy, ADR and RevPAR comparisons between 2024 and 2023 reflect properties that are comparable in both years.

Click here for Q4 2024 Press Release Schedules, including non-GAAP reconciliations and explanations.About Marriott InternationalMarriott International, Inc. (Nasdaq: MAR) is based in Bethesda, Maryland, USA, and encompasses a portfolio of over 9,300 properties across more than 30 leading brands in 144 countries and territories. Marriott operates, franchises, and licenses hotel, residential, timeshare, and other lodging properties all around the world. The company offers Marriott Bonvoy, its highly awarded travel platform.

Crédit photo © Marriott International

Crédit photo © Marriott International

|

|

1See the press release schedules for the adjusted EBITDA calculations.

1See the press release schedules for the adjusted EBITDA calculations.