WYNDHAM HOTELS & RESORTS REPORTS STRONG THIRD QUARTER RESULTS

Company raises full-year 2024 EPS outlook and reaffirms remaining outlook. |

|

WYNDHAM HOTELS & RESORTS REPORTS STRONG THIRD QUARTER RESULTS

Company raises full-year 2024 EPS outlook and reaffirms remaining outlook. |

Catégorie : Monde - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 30-10-2024

Grows System Size by 4% and Development Pipeline by 5%Wyndham Hotels & Resorts (NYSE: WH) today announced results for the three months ended September 30, 2024.

Highlights include:

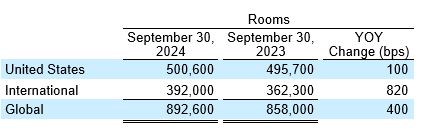

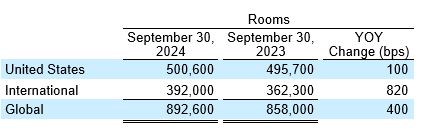

- System-wide rooms grew 4% year-over-year.

- Opened over 17,000 rooms globally, including nearly 7,000 in the U.S., which increased 15% year-over-year, and the second ECHO Suites Extended Stay by Wyndham.

- Awarded 197 development contracts globally, including 95 contracts in the U.S., which increased 10% year-over-year.

- Development pipeline grew 1% sequentially and 5% year-over-year to a record 248,000 rooms.

- Global RevPAR grew 1% in constant currency.

- Ancillary revenues increased 8% compared to third quarter 2023.

- Diluted earnings per share increased 7%, to $1.29, and adjusted diluted EPS grew 6%, to $1.39, or approximately 10% on a comparable basis.

- Net income was $102 million for the third quarter, a 1% decrease over the prior-year quarter; adjusted net income was $110 million, a 1% decrease over the prior-year quarter, or a 3% increase on a comparable basis.

- Adjusted EBITDA increased 4% compared with the prior-year quarter, to $208 million, or 7% on a comparable basis.

- Returned $126 million to shareholders through $97 million of share repurchases and quarterly cash dividends of $0.38 per share.

“Our teams around the world once again delivered exceptional results, executing our long-term growth strategy and achieving 7% growth in comparable adjusted EBITDA fueled by continued system expansion, higher royalty rates and growth in our ancillary revenues,” said Geoff Ballotti, president and chief executive officer.

“We awarded 10% more franchise contracts domestically this quarter, driving 5% growth in our development pipeline. Stabilizing RevPAR trends and improving comparisons coupled with increased infrastructure demand are expected to pave the way for improved results in the coming quarters. We remain steadfast in our long-term strategy, aimed at delivering outstanding value to our guests, franchisees and shareholders to whom we’ve returned nearly $380 million year-to-date in the form of dividends and share repurchases.”

System Size and Development

The Company’s global system grew 4%, reflecting 1% growth in the U.S. and 8% internationally. As expected, these increases included 3% growth in the higher RevPAR midscale and above segments in the U.S., as well as strong growth in the Company’s EMEA and Latin America regions, which each grew 11%. The Company continued to improve its retention rate and remains solidly on track to achieve its net room growth outlook of 3 to 4% for the full year 2024.

On September 30, 2024, the Company’s global development pipeline consisted of approximately 2,100 hotels and 248,000 rooms, representing another record-high level and a 5% year-over-year increase.

Key highlights include:

- 7% growth in the U.S. and 3% internationally

- 17th consecutive quarter of sequential pipeline growth

- Approximately 70% of the pipeline is in the midscale and above segments, which grew 6% year-over-year

- Approximately 14% of the pipeline represents ECHO Suites Extended Stay by Wyndham for which the Company has awarded a total of 283 contracts since its launch.

- Approximately 58% of the pipeline is international

- Approximately 79% of the pipeline is new construction and approximately 35% of these projects have broken ground

- During the third quarter of 2024, the Company awarded 197 new contracts, including 95 contracts in the U.S., which increased 10% year-over-year.

RevPAR

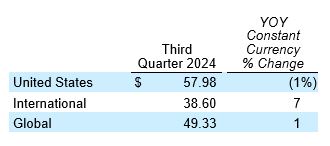

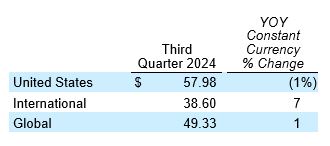

Third quarter global RevPAR increased 1% in constant currency compared to 2023, reflecting a 1% decline in the U.S. and 7% growth internationally.

In the U.S., RevPAR for the Company’s midscale and above segments was unchanged year-over-year while RevPAR for its economy segment declined 2% reflecting a modest acceleration from the second quarter with a sequential improvement of 10 basis points. Additionally, the Company’s U.S. economy brands continued to strengthen their position, gaining 50 basis points of market share in the third quarter driven by performance in oil and gas markets, which grew 250 basis points in the quarter, and in the five states with the highest infrastructure bill spend, which collectively grew 80 basis points. U.S. occupancy remained consistent, highlighting the resilience of the select-service space and consumer demand for these products.

|

|