NMH - RESULTS FOR FINANCIAL YEAR 2024 (Maurice)

New Mauritius Hotels Ltd (NMH) announces its financial results for the year ended 30 June 2024. |

|

NMH - RESULTS FOR FINANCIAL YEAR 2024 (Maurice)

New Mauritius Hotels Ltd (NMH) announces its financial results for the year ended 30 June 2024. |

Catégorie : Afrique Océan Indien - Maurice - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 22-10-2024

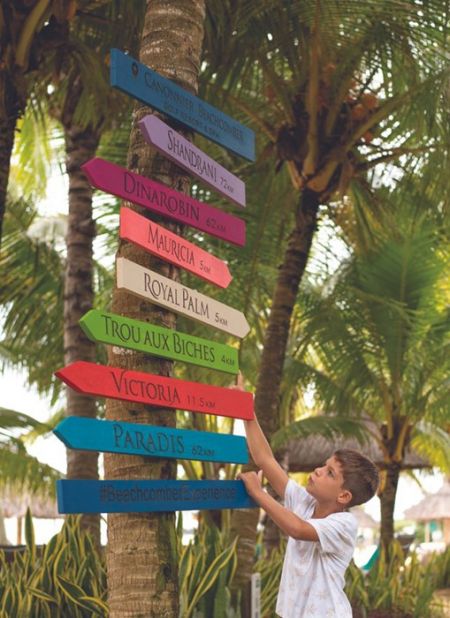

Crédit photo © Beachcomber Resorts & Hotels

“NMH has reached a milestone by surpassing the Rs 15 billion revenue mark for the first time, while maintaining a commendable profitability rate despite rising operational costs. This success is the result of the dedication and expertise of our Artisans, to whom I express my warmest thanks. In recognition of this achievement, a bonus will be granted to all our teams in September 2024 along with their monthly salaries. We approach the 2025 financial year with confidence, supported by our new 'Be' communication campaign, our ‘People-first’ philosophy, and our strong commitment to Sustainability, which will continue to drive our growth, ” says Stéphane Poupinel de Valencé, CEO of NMH.

Performance in Mauritius

The tourism sector in Mauritius has remained resilient, with 1.3 million tourist arrivals, an 8.8% increase from the prior year. Revenue from the Group’s hotel operations in Mauritius rose by 11% to Rs 11.1 billion, despite an occupancy rate of 73%, compared to 74% in 2023.

The slight dip in occupancy was due to the ongoing renovation works at our resorts, notably Paradis Beachcomber Golf Resort & Spa, Shandrani Beachcomber Resort & Spa, and Canonnier Beachcomber Golf Resort & Spa. Additionally, Victoria Beachcomber Resort & Spa, Dinarobin Beachcomber Golf Resort & Spa and Royal Palm Beachcomber Luxury were partially closed from mid-May 2024 for refurbishments.

With regard to costs, inflationary pressures persisted throughout the year. Staff costs increased by 15% year-on-year, mainly due to local labour shortages and changes in employment conditions, including adjustments to minimum wages, overtime, and paid leave. Operating costs also rose by 15%, driven by higher expenses for maintenance, security, and transport services following changes in labour laws and regulations.

Despite these temporary closures and significant cost increases, the overall results remain robust, supported by favourable exchange rates and an increase in direct bookings, yielding higher returns.

EBITDA from the Group’s hotel operations in Mauritius stood at Rs 3.7 billion, up from Rs 3.5 billion the previous year. These strong results have enabled the Group to award a Performance Bonus equivalent to two months' salary to all Artisans across Beachcomber hotels.

Morocco

NMH operations were impacted by the earthquake that occurred in Marrakech during the first quarter, leading to a temporary hotel’s closure. Revenue for the year stood at Rs 1.1 billion, compared to Rs 1.2 billion in 2023, with EBITDA at Rs 231 million, inclusive of Rs 121.5 million in net insurance proceeds for business interruption and material damage. The Moroccan tourism industry was also affected by the ongoing conflict in the Middle East, exacerbating the challenges faced during the financial year.

Seychelles

In February 2024, the annual rent for the hotel on Sainte Anne Island in Seychelles, leased to Club Med, was raised by 2%, as per the lease agreement. Due to additional work on staff accommodation, a fair value loss of Rs 69 m was recognised, compared to a gain of Rs 109 million in 2023. This situation impacted EBITDA, which stood at Rs 339 million, down from Rs 510 million in 2023.

Tour operating

The Group’s Tour operators in South Africa, UK, France, and Mauritius continued to contribute positively to the bottom line.

However, revenue growth remains marginal due to fewer room nights available for sale. Revenue for this segment amounted to Rs 2.2 billion, up from Rs 2.1 billion in 2023, while EBITDA reaches Rs 452 million, slightly down from Rs 515 million the previous year.

Inflight & Inland Catering

The Inflight and Inland Catering segment experienced a strong rebound, driven by increased passenger travel, contractual price reviews, and higher demand in the retail, educational and medical sectors. Revenue rose to Rs 530 million, compared to Rs 374 million in 2023, and EBITDA turned positive at Rs 39 million, compared to negative Rs 22 million last year.

Net indebtedness

The Group's net borrowings decreased by Rs 1.6 billion year-on-year, improving our gearing ratio by 10%, in line with our objectives. The net debt-to-EBITDA ratio stood at a comfortable 3.4 times, and the asset cover ratio at 2.65 times. Interest costs were contained at Rs 1.2 billion, compared to Rs 1.1 billion in 2023, despite the full-year impact of increased interest rates. Following the CARE Rating of A- in the third quarter, interest costs have been adjusted downwards, with the full effect expected to be reflected in the next financial year ending 30 June 2025.

Dividends

NMH has declared a dividend of Re 0.33 per preference share for the six-month period ended 30 June 2024, bringing the total preference share dividend for the year to Re 0.66 per share. NMH also approved an interim ordinary share dividend of Re 0.20 in January 2024 and a final dividend of Re 0.30 in May 2024.

Project updates

Construction work is progressing well on our 18-hole Harmonie Golf Course at Les Salines, Black River, marking a significant first step towards the development of the future Harmonie Beachcomber Golf Resort.

NMH also continues to strengthen its innovation and digitalisation initiatives, rolling out several projects that are transforming the Group’s operations through www.beachcomber.com enhanced Guest interactions and improved Artisan experience. At the same time, the Group is maintaining its investments in modernising its infrastructure, paving the way for efficiency gains and new growth opportunities.

Outlook

NMH expects strong results for the first quarter of financial year 2025 (1 July – 30 September 2024), with fewer rooms closed for renovation compared to last year. From mid-October 2024, the entire room inventory will be available for sale again. With booking levels similar to the previous year, the Group anticipates solid performances for the first six months of the new financial year.

Crédit photo © Beachcomber Resorts & Hotels

Crédit photo © Beachcomber Resorts & Hotels

|

|