SOLID ACTIVITY GROWTH RAISED FULL-YEAR GUIDANCE

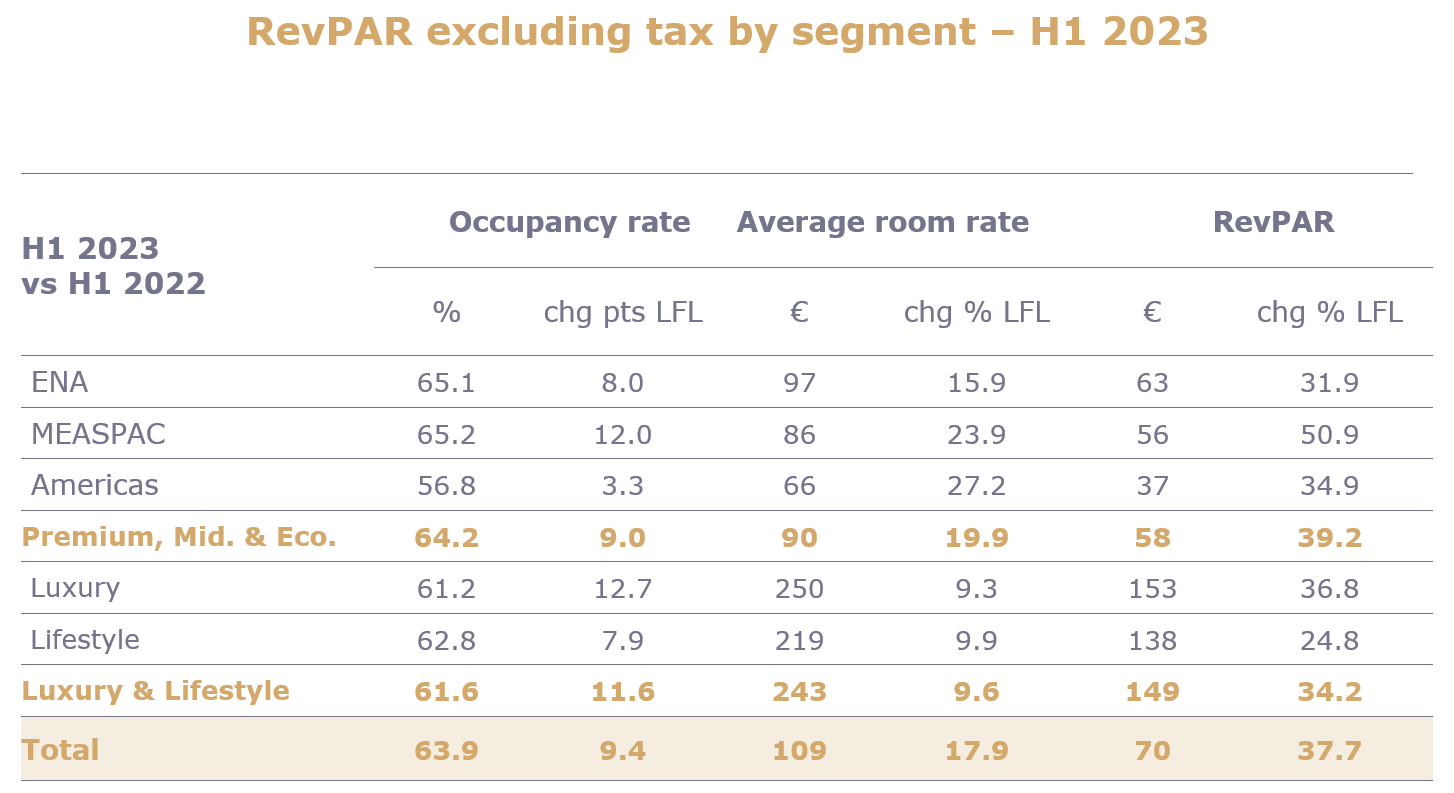

H1 2023 RevPAR up 38% vs H1 2022 |

|

SOLID ACTIVITY GROWTH RAISED FULL-YEAR GUIDANCE

H1 2023 RevPAR up 38% vs H1 2022 |

Catégorie : Monde - Économie du secteur

- Chiffres et études

Ceci est un communiqué de presse sélectionné par notre comité éditorial et mis en ligne gratuitement le 31-07-2023

Demand expected to remain strong for the coming months

Sébastien Bazin, Chairman and Chief Executive Officer of Accor, said:

"Half-year activity growth was very strong across all of our brands and markets. These good performances are underpinned by the rigorous execution of our strategy, the attractiveness of our brands and the commitment of our teams. This momentum should continue for the coming months, driven by robust demand in both leisure and business tourism. The performance enables us to raise our 2023 guidance and to continue investing in our brands, talents and digital tools".

Business trends in Q2 2023 were solid in the Group's two divisions. Hotel demand from both leisure and business guests remained buoyant. This was shown by the improvement in occupancy rates and a sustained increase in average room rates.

These results enable the Group to raise its full-year EBITDA guidance presented at the Capital Markets Day on June 27th, 2023.

During first-half 2023, Accor opened 114 hotels, representing 14,500 rooms, i.e. net unit growth of 3.5% in the last 12 months. At end-June 2023, the Group had a hotel portfolio of 805,436 rooms (5,487 hotels) and a pipeline of 217,000 rooms (1,262hotels).

For 2023, the Group is confirming its forecast of net unit growth of the network between 2% and 3%.

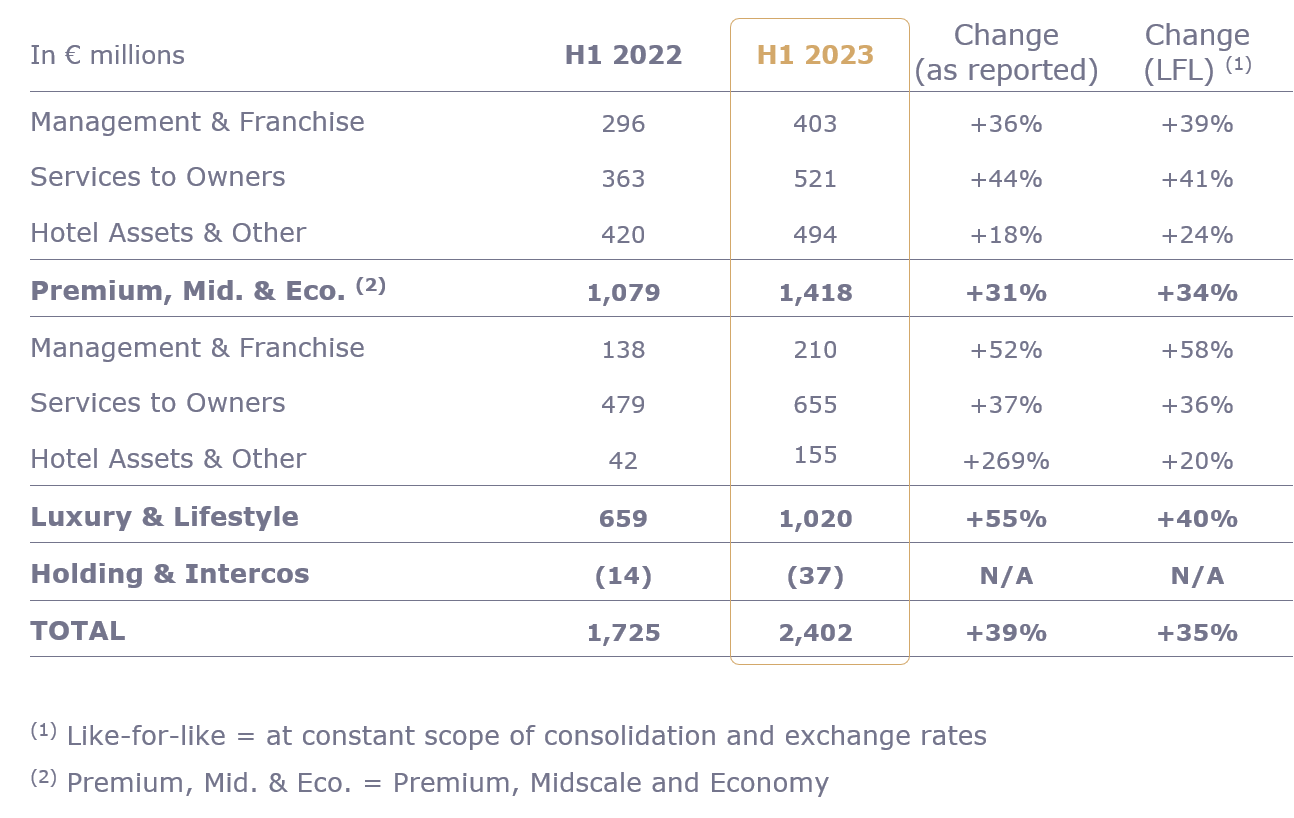

Consolidated revenue

The Group reported H1 2023revenueof €2,402 million, up 35% like-for-like (LFL) versus H1 2022. This growth breaks down into a 34% increase for the Premium, Midscale and Economy division and 40% for the Luxury & Lifestyle division.

Changes in the scope of consolidation, mainly due to the consolidation of Paris Society in the Luxury & Lifestyle division (Hotel Assets & Other segment), contributed positively by €139 million.

Currency effects had a negative impact of €61 million, stemming mainly from the Australian Dollar (+5%), the Egyptian Pound (+75%) and the Turkish Lira (+32%).

Premium, Midscale and Economy revenue

Premium, Midscale and Economy, which includes fees from Management & Franchise (M&F), Services to Owners and Hotel Assets & Other activities of the Group's Premium, Midscale and Economy brands, generated revenue of €1,418 million, up 34% LFL versus H1 2022. This increase was in line with the recovery in business over the period.

Management & Franchise (M&F)revenue stood at €403 million, up 39% LFL versus H1 2022 and in line with the increase in RevPAR over the period (+39%). The regional performance of Management & Franchise is detailed in the following pages.

Services to Ownersrevenue, which includes the activities of Sales, Marketing, Distribution and Loyalty, as well as shared services and the reimbursement of hotel staff costs, reached to €521 million in H1 2023, up 41% LFL year on year.

Hotel Assets & Otherrevenue was up 24% LFL relative to H1 2022. This segment is closely tied to Australia, which recovered faster than the rest of the Group, impacting the year-on-year growth.

Luxury & Lifestyle revenue

Luxury & Lifestyle, which includes fees from Management & Franchise (M&F), Services to Owners and Hotel Assets & Other activities of the Group's Luxury & Lifestyle brands, generated revenue of €1,020 million, up 40% LFL versus H1 2022. This increase also reflected the surge in business over the period.

Management & Franchise (M&F)revenue stood at €210 million, up 58% LFL versus H1 2022, driven by the increase in RevPAR and a sharp acceleration in hotel incentive fees under management contracts. The segment performance of Management & Franchise is detailed in the following pages.

Services to Ownersrevenue which includes the Sales, Marketing, Distribution and Loyalty division, as well as shared services and the reimbursement of hotel staff costs, came to €655 million in H1 2023, up 36% LFL year on year.

Hotel Assets & Otherrevenue was up 20% LFL relative to H1 2022. It included a significant scope effect following the consolidation of Paris Society at end-2022.

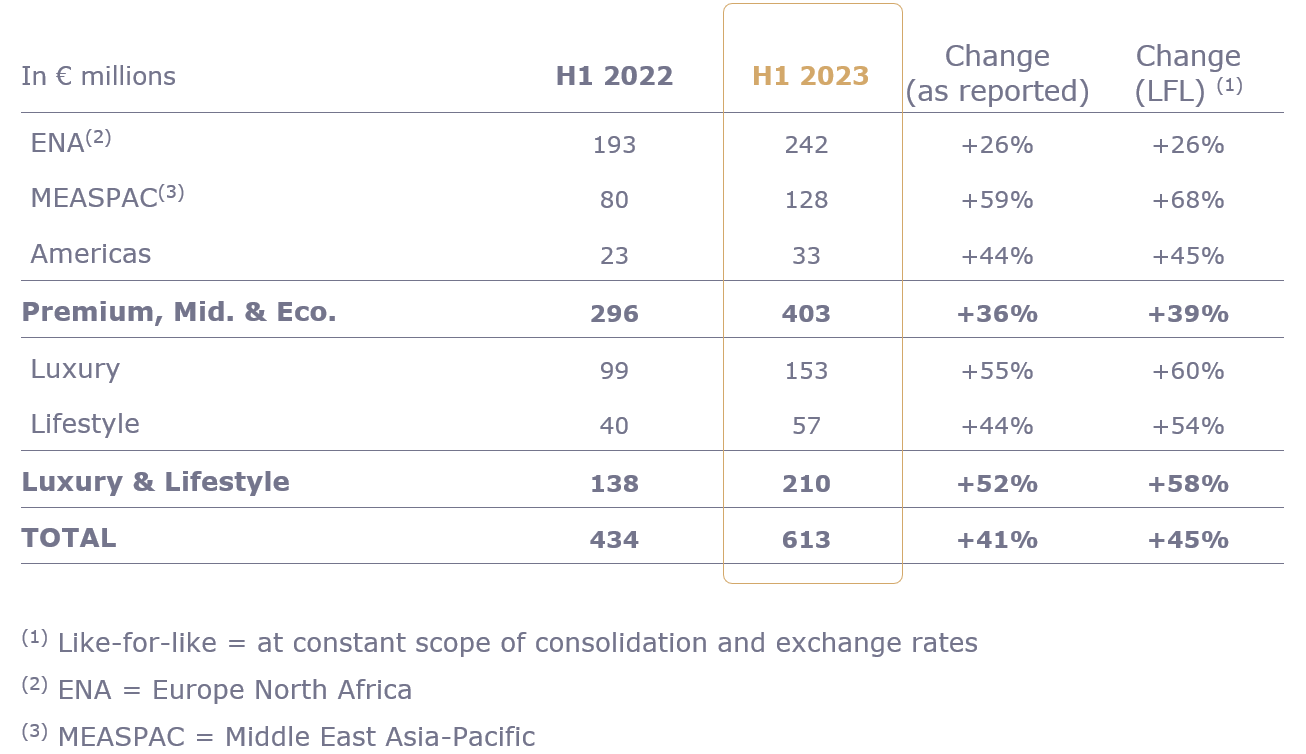

Management & Franchise (M&F) revenue

Management & Franchise (M&F)revenue stood at €613 million, up 45% LFL versus H1 2022. This reflected the increase in RevPAR in the Group's various regions and segments (+38% vs H1 2022) which was accelerated by the surge in incentive fees.

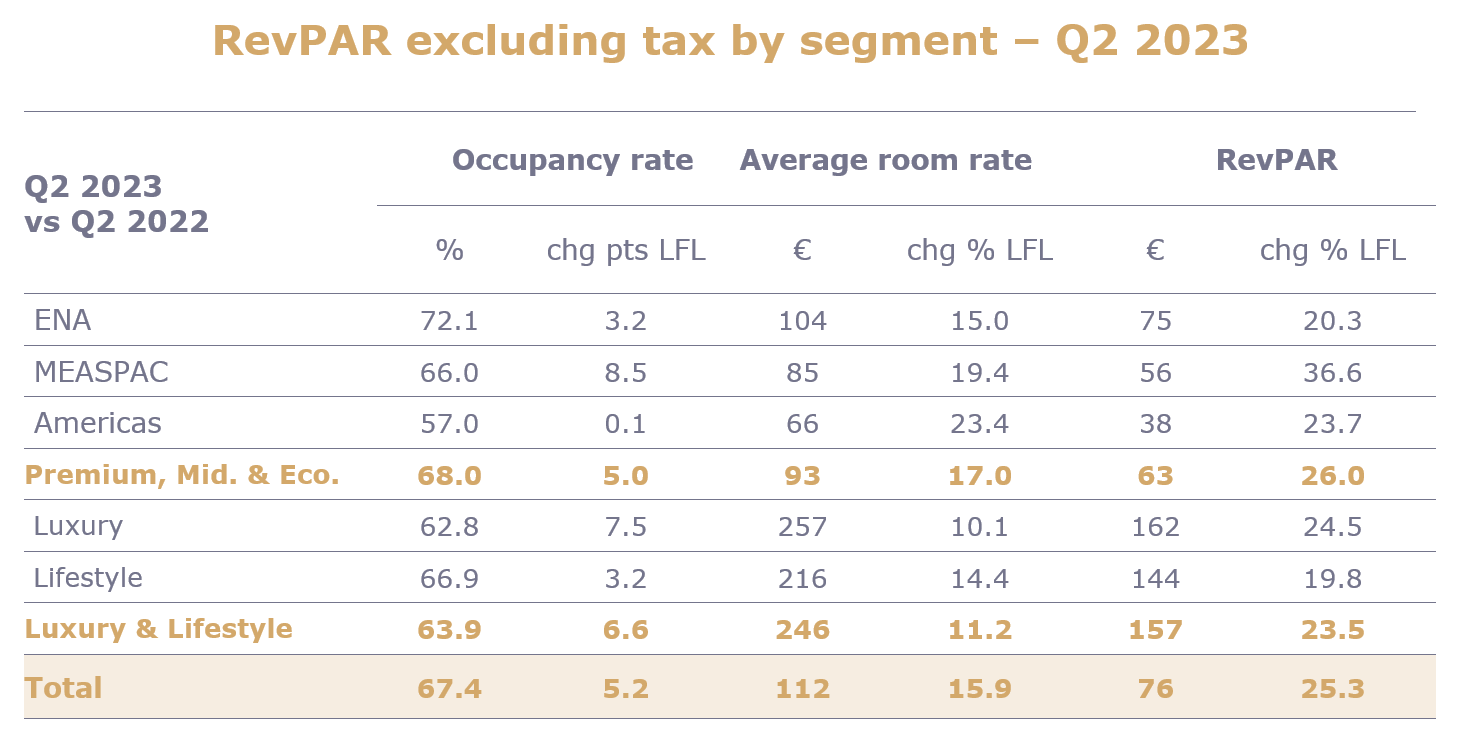

Consolidated RevPARcontinued its sequential rise in H1 2023, up 25% in Q2 compared with Q2 2022 (and +27% vs Q2 2019).

ThePremium, Midscale and Economydivision grew its RevPAR by 26% versus Q2 2022, still mostly driven by prices rather than the rise in occupancy rates.

- TheEurope North Africa (ENA)region posted RevPAR up 20% relative to Q2 2022.

- InFrance, which accounts for 45% of the region's room revenue, RevPAR remained solid, underpinned in particular by the influx of international leisure and business guests to Paris for major events such as the Paris Air Show, Viva Tech and the French Open tennis tournament at Roland-Garros. Social unrest at end-June had no significant impact on the quarter or on summer bookings.

- TheUnited Kingdom, which represents 12% of the region's room revenue, posted balanced growth in RevPAR between London and other cities.

- InGermany, which accounts for 13% of the region's room revenue, RevPAR improved significantly in the second quarter, but nevertheless continued to lag behind the rest of Europe.

- TheMiddle East Asia-Pacificregion reported a 37% increase in RevPAR compared with Q2 2022, benefiting from a considerable rebound in business in Asia.

- Accounting for 27% of the region's room revenue, theMiddle Eastcontinued to post solid performances despite the end of last year's exceptional events (Expo 2020 in Dubai and the Soccer World Cup in Qatar). The holy cities in Saudi Arabia notably benefited from religious pilgrimages for Ramadan (beginning of the second quarter) and the Hajj (end of the second quarter).

- ThePacific, which accounts for 25% of room revenue for the region, maintained stable revenue compared with previous quarters.

- South-East Asia, which accounts for 27% of the region's room revenue, restored pre-crisis levels, especially in major cities, bolstered by the return of international business clients.

- InChina, which represents 21% of room revenue for the region, while a strong recovery has been noticeable since the start of the year, there is still room for considerable growth, as business has not yet returned to pre-crisis levels.

- TheAmericasregion, which mainly reflects the performances of Brazil (63% of room revenue for the region), maintained a solid level of business driven solely by prices, since the region had already returned to its 2019 occupancy rate.

TheLuxury & Lifestyledivision reported a 24% increase in RevPAR compared with Q2 2022, driven by both higher occupancy rates and prices.

- Luxury, which accounts for 77% of the division's room revenue, posted a 25% increase in RevPAR compared with second-quarter 2022. This increase was particularly driven by the MEASPAC region where growth was very robust.

- LifestyleRevPAR increased 20% compared with Q2 2022. This performance reflected a less favorable base effect as it was the segment to stage the most substantial recovery at the end of the crisis.

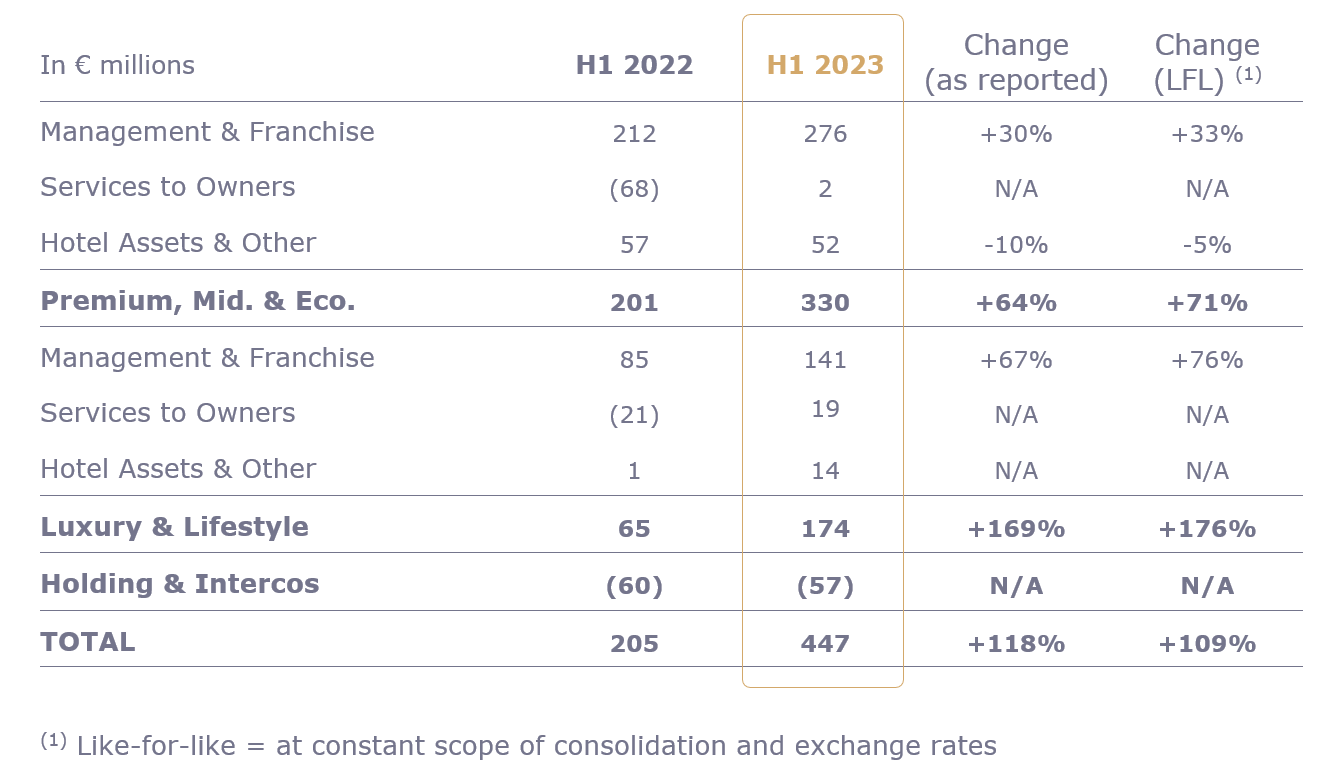

Consolidated EBITDA

Consolidated EBITDAstood at €447 million in H1 2023, i.e. more than double the figure reported in H1 2022. This performance was linked to the strong recovery in activity and strict discipline in costs of Services to Owners, enabling the Group to post a marginally positive EBITDA as expected for this activity.

Premium, Midscale and Economy EBITDA

ThePremium, Midscale and Economydivision generated EBITDA of €330 million, up 71% LFL versus H1 2022.

TheManagement & Franchise (M&F)business posted EBITDA of €276 million, up 33% LFL versus H1 2022.

Services to OwnersEBITDA came to €2 million in H1 2023, slightly positive as a result of strict cost control.

Hotel Assets & OtherEBITDA was down 5% LFL relative to H1 2022. This decline was mainly due to cost inflation in Australia.

Luxury & Lifestyle EBITDA

TheLuxury & Lifestyledivision generated EBITDA of €174 million, up 176% LFL relative to H1 2022.

TheManagement & Franchise (M&F)business posted EBITDA of €141 million, up 76% LFL versus H1 2022.

Services to OwnersEBITDA came to €19 million in H1 2023, also slightly positive as a result of strict cost control.

Hotel Assets & OtherEBITDA mostly reflected the consolidation of Paris Society since end-2022.

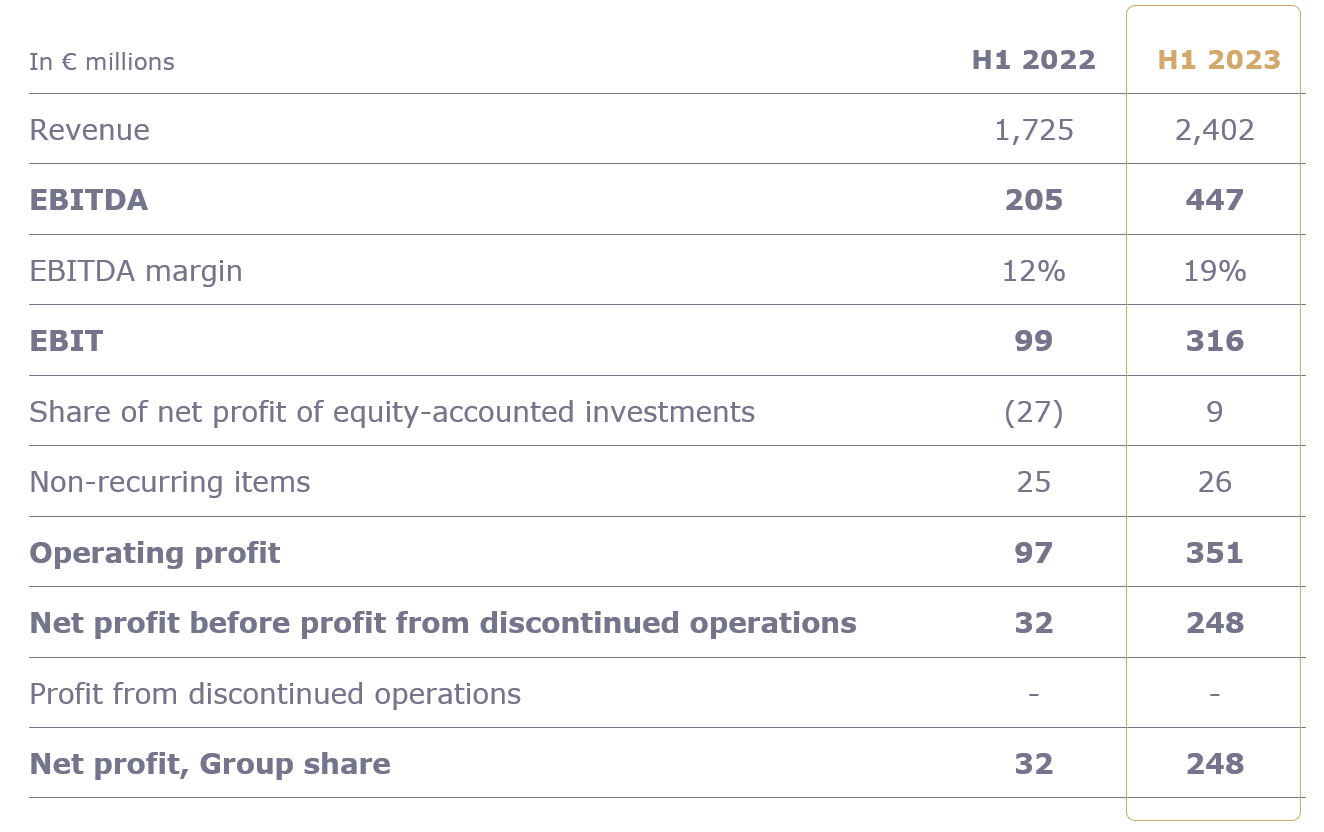

Net profit

Net profit, Group sharewas €248 million in H1 2023, compared with €32 million in H1 2022.

The improvement in theshare of net profit of equity-accounted investments,positive at €9 million vs a negative of €(27) million in H1 2022, is primarily driven by the recovery at AccorInvest, which enjoyed a rebound in business, particularly in Europe.

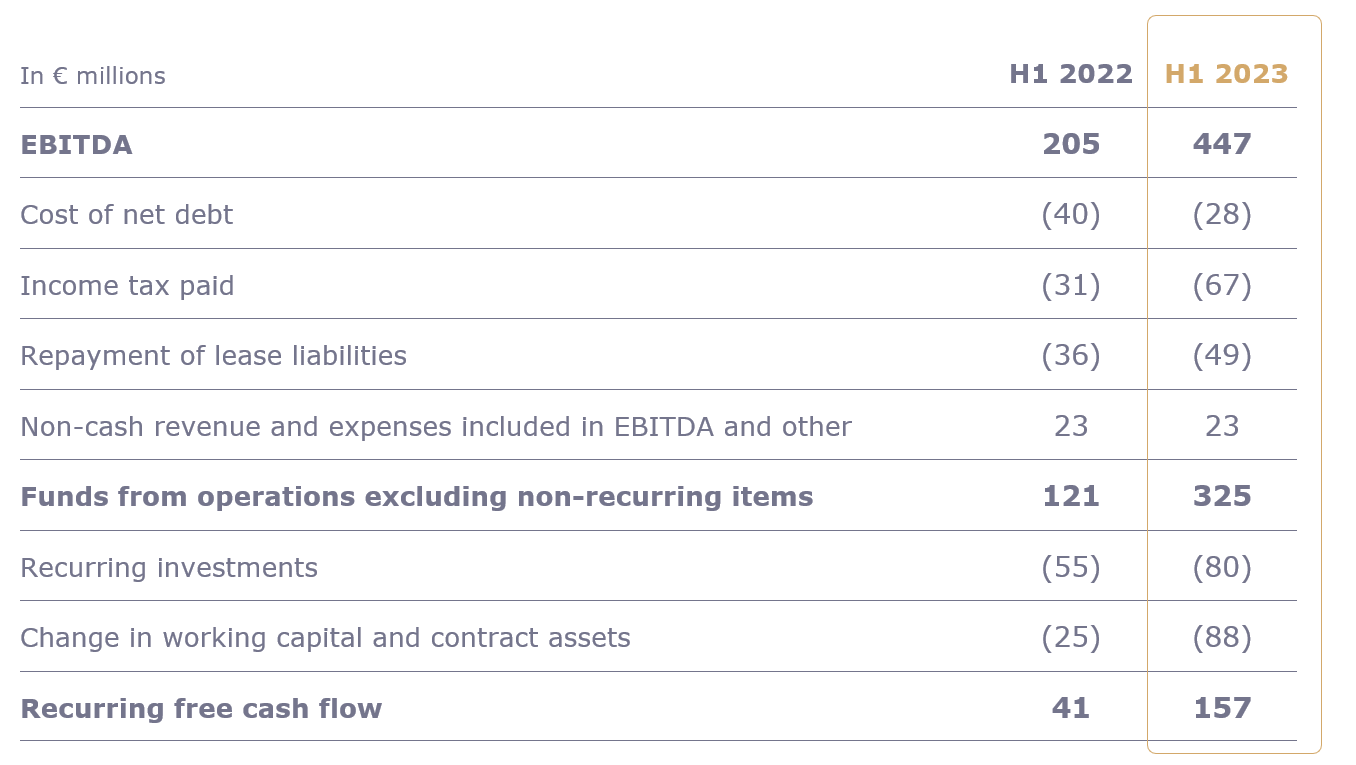

Cash flow generation

During H1 2023, the Group’srecurring free cash flowimproved significantly, from €41 million in H1 2022 to €157 million in H1 2023.

The cost of net debtdecreased from H1 2022 to H1 2023, benefiting from the rise in interest rates on cash investments.

Recurring expenditure, which includes "key money" paid for development as well as digital and IT investments, was slightly higher than in first-half 2022 at €80 million, given the Group's acceleration in the Luxury & Lifestyle segment. Recurring investments in 2023 are expected to be higher than €200 million.

Change in working capitalis seasonal by nature and reflects the recovery in business reported in H1 2023.

Groupnet financial debtstood at €1,837 million at end-June 2023, versus

€1,658 million at December 31, 2022.

On June 30, 2023, Accor'saverage cost of debtwas 2.5% with anaverage maturityof around three years, with no major repayments due before 2026.

At end-June 2023, combined with the undrawn credit facility of €1.2 billion, Accor had a liquidity position of €2.7 billion.

Outlook for 2023

Based on the first-half performance and considering the current macro-economic uncertainties, the Group raises the guidance for fiscal year 2023:

- Growth in RevPAR now expected at the top end of the 15-20% range.

- Consolidated EBITDA now expected between €930 million and €970 million (previously between €920 million and €960 million)

Events in first-half 2023

Appointment of Omer Acar

On January 3rd, 2023, Accor announced the appointment of Omer Acar as CEO Raffles & Orient Express, effective from March 1st, 2023.

Appointment of Kamal Rhazali

On January 3rd, 2023, Accor announced the appointment of Kamal Rhazali as Secretary General and General Counsel of its Luxury & Lifestyle division, effective from February 1st, 2023.

Appointment of Martine Gerow

On April 12th, 2023, Accor announced the appointment of Martine Gerow as Group Chief Finance Officer. Martine Gerow took up her position on July 1st, 2023, reporting directly to Sébastien Bazin, Group Chairman & CEO. She replaces Jean-Jacques Morin, Group Deputy CEO and now Premium, Midscale & Economy division CEO.

Martine is a graduate of HEC and holds an MBA degree from Columbia Business School. With a strong French and Anglo-US background, Martine started her career as a consultant at the Boston Consulting Group in New York. She then joined PepsiCo and, in 2002, moved to Danone where she served as division CFO and Group Controller based in Paris. Martine joined the travel industry in 2014, first as CFO of Carlson Wagon Lit Travel, and, since 2017, as CFO of American Express Global Business Travel, based in London.

Appointments following the Shareholders' Meeting

Accor's Board of Directors approved the appointment of

Ms. Anne-Laure Kiechel as an independent director. Ms. Kiechel will contribute her extensive knowledge of international geo-economic and financial issues.

The Board of Directors also decided to renew the terms of office of Mr. Sébastien Bazin, Chairman and Chief Executive Officer, Ms. Iris Knobloch, Vice-Chairman of the Board and Senior Independent Director, and Mr. Bruno Pavlovsky, Chairman of the Appointments and Compensation Committee.

Disposal of the remaining stake in H World Group Limited (Huazhu)

On January 18th, 2023, Accor announced that it had completed the disposal of the stake in H World Group Limited (previously Huazhu Group Limited) for $460m (of which $162m in 2022). This transaction serves to finalize the value creation of the investment initiated in 2016. The cumulated disposal value since 2019 reaches $1.2bn, vs an initial investment of less than $200m. This contributes to the asset-light strategy to simplify the Group’s balance sheet. After this transaction, Accor no longer owns any stake in H World Group Limited.

Disposal of the Paris headquarters building to Valesco Group for €460 million

In line with the announcement made on September 28th, 2022, Accor announces having successfully completed the disposal of its headquarters building, “Sequana Tower”, for €460 million to the Valesco Group. This transaction is the largest office deal of the year in Continental Europe and largest office deal in France since 2022.

The transaction structure includes a 12-year sale and leaseback agreement with an initial annual rent of €22 million, and a subordinated loan of €100 million to the Valesco Group.

Sale of stake in Risma and reaffirmed development ambitions in Morocco

As part of the implementation of its asset-light strategy, Accor announces that it has reached an agreement with Mutris – a Moroccan investment company bringing together private and institutional investors – under which Accor will, firstly, sell its 33% stake in Risma, Morocco’s leading publicly listed hotel operator, to Mutris at a price of 130 dirhams per share, and secondly, sell its Risma bonds on the market.

Completion of the transaction is subject to certain regulatory approvals, with the transaction expected to close in the third quarter of 2023.

Subsequent events

On July 21st, 2023, Accor and the shareholders of Potel & Chabot, including Andera Partners, announced that they had entered into exclusive negotiations for Accor to acquire a 63% stake in Potel & Chabot, in addition to the 37% already owned by the Group. After this transaction, Accor will become the sole shareholder of Potel & Chabot which will be consolidated within the Group's Luxury & Lifestyle division. The contemplated transaction is subject to customary regulatory authorizations and consultation with employee representative bodies. Closing is expected to occur in the fall of 2023.

Additional information

The Board of Directors met on July 26th, 2023 and reviewed the interim financial statements ending on June 30th, 2023. The limited review procedures on the consolidated financial statements were carried out by the statutory auditors. Their report is currently being prepared. The consolidated financial statements and notes related to this press release are available on thewww.accor.com website.

About Accor

Accor is a world-leading hospitality group offering experiences across more than 110 countries in 5,500 properties, 10,000 food & beverage venues, wellness facilities and flexible workspaces. The Group has one of the industry’s most diverse hospitality ecosystems, encompassing more than 40 hotel brands from luxury to economy, as well as Lifestyle with Ennismore. Accor is committed to taking positive action in terms of business ethics & integrity, responsible tourism, sustainable development, community outreach, and diversity & inclusion. Founded in 1967, Accor SA is headquartered in France and publicly listed on Euronext Paris (ISIN: FR0000120404) and on the OTC Market (Ticker: ACCYY) in the United States.

|

|