MARRIOTT INTERNATIONAL REPORTS THIRD QUARTER 2024 RESULTS

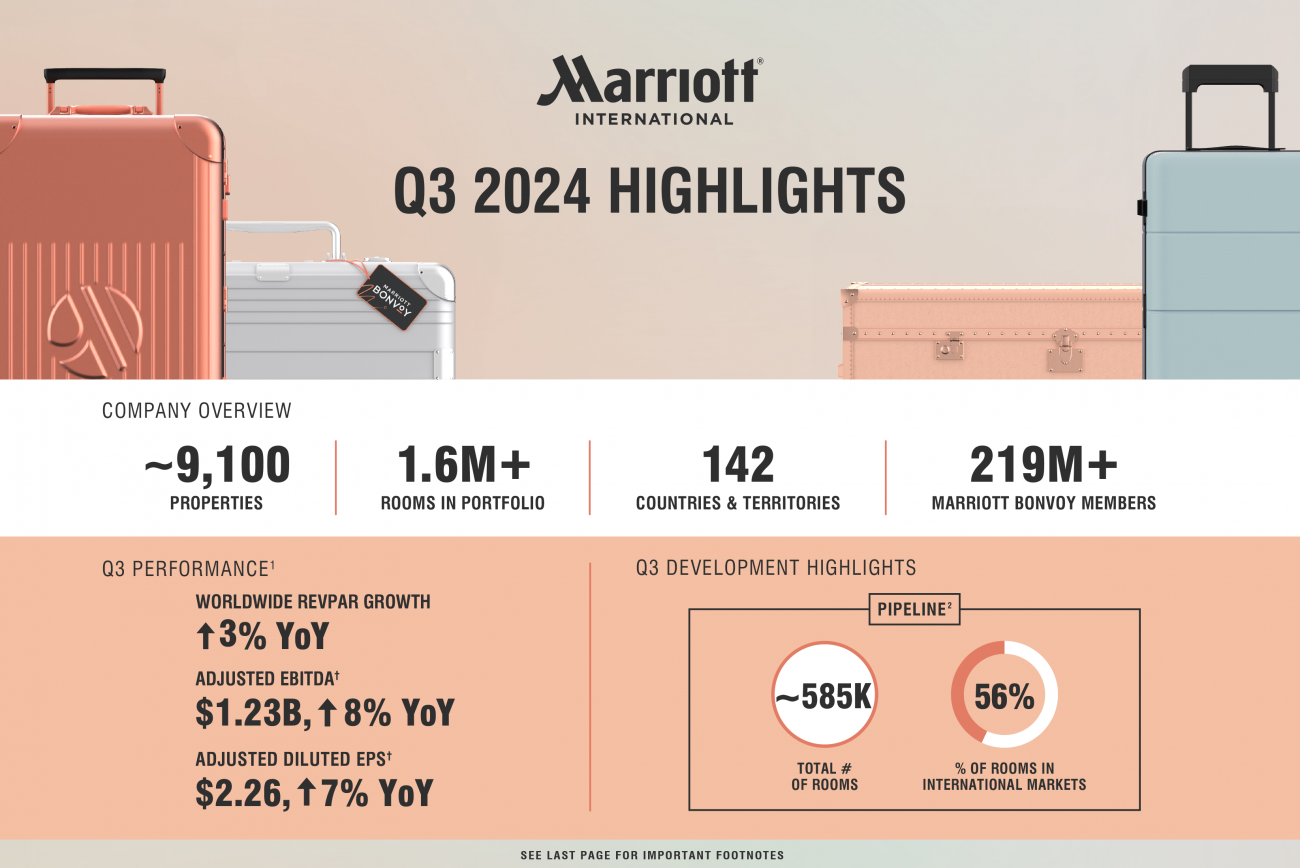

Third quarter 2024 comparable systemwide constant dollar RevPAR increased 3.0 percent worldwide, 2.1 percent in the U.S. & Canada, and 5.4 percent in international markets, compared to the 2023 third quarter;. |

|

MARRIOTT INTERNATIONAL REPORTS THIRD QUARTER 2024 RESULTS

Third quarter 2024 comparable systemwide constant dollar RevPAR increased 3.0 percent worldwide, 2.1 percent in the U.S. & Canada, and 5.4 percent in international markets, compared to the 2023 third quarter;. |

Category: Worldwide - Industry economy

- Figures / Studies

This is a press release selected by our editorial committee and published online for free on 2024-11-05

Photo credit © Marriott International

- Third quarter reported diluted EPS totaled $2.07, compared to reported diluted EPS of $2.51 in the year-ago quarter. Third quarter adjusted diluted EPS totaled $2.26, compared to third quarter 2023 adjusted diluted EPS of $2.11;

- Third quarter reported net income totaled $584 million, compared to reported net income of $752 million in the year-ago quarter. Third quarter adjusted net income totaled $638 million, compared to third quarter 2023 adjusted net income of $634 million;

- Adjusted EBITDA totaled $1,229 million in the 2024 third quarter, compared to third quarter 2023 adjusted EBITDA of $1,142 million;

- The company added roughly 16,000 net rooms during the quarter;

- At the end of the quarter, Marriott’s worldwide development pipeline totaled approximately 3,800 properties and 585,000 rooms, including roughly 34,000 pipeline rooms approved, but not yet subject to signed contracts. More than 220,000 rooms in the pipeline were under construction as of the end of the third quarter;

- Marriott repurchased 4.5 million shares of common stock for $1.0 billion in the third quarter. Year to date through October 31, the company has returned $3.9 billion to shareholders through dividends and share repurchases.

Marriott International, Inc. (Nasdaq: MAR) today reported third quarter 2024 results.

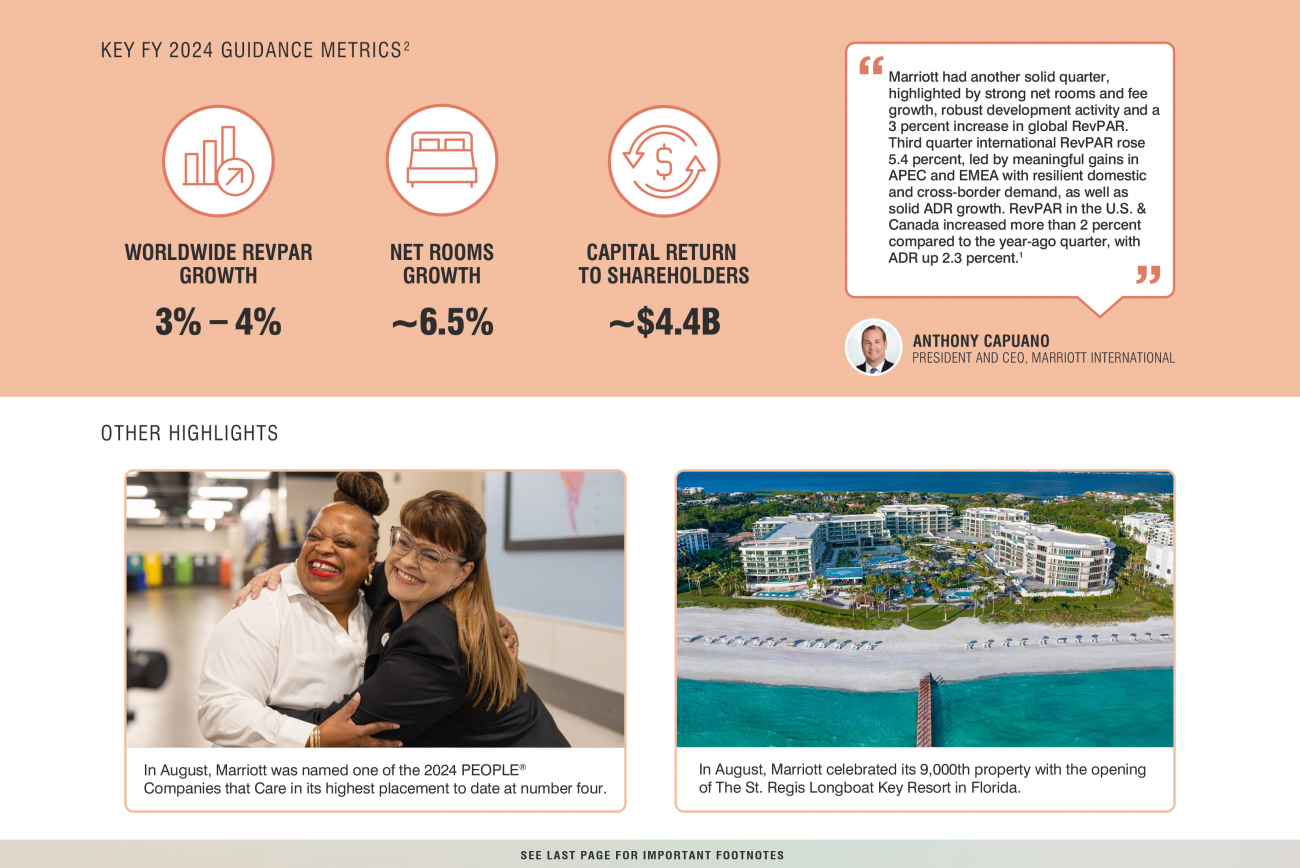

Anthony Capuano, President and Chief Executive Officer, said, “Marriott had another solid quarter, highlighted by strong net rooms and fee growth, robust development activity and a 3 percent increase in global RevPAR[1]. Third quarter international RevPAR rose 5.4 percent, led by meaningful gains in APEC and EMEA with resilient domestic and cross-border demand, as well as solid ADR growth. RevPAR in the U.S. & Canada increased more than 2 percent compared to the year-ago quarter, with ADR up 2.3 percent.

“Group remained the standout customer segment, with global group RevPAR rising 10 percent in the quarter and on pace to rise 8 percent for full year 2024. RevPAR for the business transient segment continued to grow nicely in the quarter, while leisure transient RevPAR was flat year over year, but still well ahead of pre-pandemic levels.

“Given the breadth and depth of our portfolio and the meaningful benefits we deliver to owners and franchisees, demand for our brands remains strong. Through the first three quarters of 2024, we signed over 95,000 organic rooms, more than half of which are outside the U.S. & Canada. More than 40 percent of signed rooms are conversions, where we continue to have a lot of momentum, particularly with multi-unit opportunities.

“Net rooms grew nearly 6 percent over the last four quarters, and our development pipeline reached a record 585,000 rooms at the end of September. Our teams remain keenly focused on expanding our industry leading global portfolio, and we now expect full year 2024 net rooms growth to be around 6.5 percent.

“Our business momentum is excellent, and we continue to evolve our business to support our numerous global growth opportunities. To that end, we have undertaken a comprehensive initiative to enhance our effectiveness and efficiency across the company. At this point in the process, we expect this initiative to yield $80 million to $90 million of annual general and administrative cost reductions beginning in 2025. In addition, we expect this work to deliver cost savings to our owners and franchisees.

“With our asset light business model generating meaningful cash and our solid financial performance, we returned $3.7 billion to shareholders through share repurchases and dividends in the first nine months of the year, and now expect to return approximately $4.4 billion for the full year 2024.”

Third Quarter 2024 Results

Base management and franchise fees totaled $1,124 million in the 2024 third quarter, a 7 percent increase compared to base management and franchise fees of $1,054 million in the year-ago quarter. The increase is primarily attributable to RevPAR increases and unit growth, as well as higher residential and co-branded credit card fees.

Incentive management fees totaled $159 million in the 2024 third quarter, an 11 percent increase compared to $143 million in the 2023 third quarter. Managed hotels in international markets contributed roughly 70 percent of the incentive fees earned in the quarter.

General, administrative, and other expenses for the 2024 third quarter totaled $276 million, compared to $239 million in the year-ago quarter. The year-over-year change largely reflects a $19 million operating guarantee reserve for a U.S. hotel, which was negotiated in connection with the company’s acquisition of Starwood, and an $11 million litigation reserve.

Interest expense, net, totaled $168 million in the 2024 third quarter, compared to $139 million in the year-ago quarter. The increase was largely due to higher interest expense associated with higher debt balances.

Marriott’s reported operating income totaled $944 million in the 2024 third quarter, compared to 2023 third quarter reported operating income of $1,099 million. Reported net income totaled $584 million in the 2024 third quarter, compared to 2023 third quarter reported net income of $752 million. Reported diluted earnings per share (EPS) totaled $2.07 in the quarter, compared to reported diluted EPS of $2.51 in the year-ago quarter.

Adjusted operating income in the 2024 third quarter totaled $1,017 million, compared to 2023 third quarter adjusted operating income of $959 million. Third quarter 2024 adjusted net income totaled $638 million, compared to 2023 third quarter adjusted net income of $634 million. Adjusted diluted EPS in the 2024 third quarter totaled $2.26, compared to adjusted diluted EPS of $2.11 in the year-ago quarter.

Adjusted results excluded cost reimbursement revenue, reimbursed expenses and restructuring and merger-related charges. See the press release schedules for the calculation of adjusted results and the manner in which the adjusted measures are determined in this press release.

Adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) totaled $1,229 million in the 2024 third quarter, compared to third quarter 2023 adjusted EBITDA of $1,142 million. See the press release schedules for the adjusted EBITDA calculation.

Selected Performance Information

The company added roughly 16,000 net rooms during the quarter.

At the end of the quarter, Marriott’s global system totaled nearly 9,100 properties, with roughly 1,675,000 rooms.

At the end of the quarter, the company’s worldwide development pipeline totaled 3,802 properties with approximately 585,000 rooms, including 232 properties with roughly 34,000 rooms approved for development, but not yet subject to signed contracts. The quarter-end pipeline included 1,320 properties with more than 220,000 rooms under construction. Fifty-six percent of rooms in the quarter-end pipeline are in international markets.

In the 2024 third quarter, worldwide RevPAR increased 3.0 percent (a 2.3 percent increase using actual dollars) compared to the 2023 third quarter. RevPAR in the U.S. & Canada increased 2.1 percent (a 1.9 percent increase using actual dollars), and RevPAR in international markets increased 5.4 percent (a 3.3 percent increase using actual dollars).

Balance Sheet & Common Stock

At the end of the quarter, Marriott’s total debt was $13.6 billion and cash and equivalents totaled $0.4 billion, compared to $11.9 billion in debt and $0.3 billion of cash and equivalents at year-end 2023.

Year to date through October 31, the company has repurchased 14.2 million shares for $3.4 billion.

In the third quarter, the company issued $500 million of Series PP Senior Notes due in 2030 with a 4.80 percent interest rate coupon and $1.0 billion of Series QQ Senior Notes due in 2035 with a 5.35 percent interest rate coupon.

Company Outlook

1 See the press release schedules for the adjusted EBITDA calculations.

2 Adjusted EBITDA and Adjusted EPS – diluted for fourth quarter and full year 2024 do not include cost reimbursement revenue, reimbursed expenses, restructuring and merger-related charges, or any asset sales that may occur during the year, each of which the company cannot forecast with sufficient accuracy and without unreasonable efforts, and which may be significant.

3 Assumes the level of capital return to shareholders noted above.

4 Includes capital and technology expenditures, loan advances, contract acquisition costs, and other investing activities.

5 Factors in the purchase of the Sheraton Grand Chicago and underlying land for $500 million, $200 million of which is included in investment spending. Assumes the level of investment spending noted above and that no asset sales occur during the year.

Marriott International, Inc. (Nasdaq: MAR) will conduct its quarterly earnings review for the investment community and news media on Monday, November 4, 2024, at 8:30 a.m. Eastern Time (ET). The conference call will be webcast simultaneously via Marriott’s investor relations website at

http://www.marriott.com/investor, click on “Events & Presentations” and click on the quarterly conference call link. A replay will be available at that same website until November 4, 2025.

The telephone dial-in number for the conference call is US Toll Free: 800-274-8461, or Global: +1 203-518-9843. The conference ID is MAR3Q24. A telephone replay of the conference call will be available from 1:00 p.m. ET, Monday, November 4, 2024, until 8:00 p.m. ET, Monday, November 11, 2024. To access the replay, call US Toll Free: 800-688-4915 or Global: +1 402-220-1319.

[1]All occupancy, Average Daily Rate (ADR) and Revenue Per Available Room (RevPAR) statistics and estimates are systemwide constant dollar. Unless otherwise stated, all changes refer to year-over-year changes for the comparable period. Occupancy, ADR and RevPAR comparisons between 2024 and 2023 reflect properties that are comparable in both years.

Marriott International, Inc.

Marriott International, Inc. (Nasdaq: MAR) is based in Bethesda, Maryland, USA, and encompasses a portfolio of nearly 9,100 properties across more than 30 leading brands in 142 countries and territories. Marriott operates and franchises hotels and licenses vacation ownership resorts all around the world. The company offers Marriott Bonvoy, its highly awarded travel program.

Marriott encourages investors, the media, and others interested in the company to review and subscribe to the information Marriott posts on its investor relations website at www.marriott.com/investor or Marriott's news center website at www.marriottnewscenter.com, which may be material. The contents of these websites are not incorporated by reference into this press release or any report or document Marriott files with the SEC, and any references to the websites are intended to be inactive textual references only.

Photo credit © Marriott International

Photo credit © Marriott International

|

|