WYNDHAM HOTELS & RESORTS REPORTS STRONG FIRST QUARTER RESULTS

Company Raises Full-Year 2024 EPS Outlook. |

|

WYNDHAM HOTELS & RESORTS REPORTS STRONG FIRST QUARTER RESULTS

Company Raises Full-Year 2024 EPS Outlook. |

Category: Worldwide - Industry economy

- Figures / Studies

This is a press release selected by our editorial committee and published online for free on 2024-04-29

- Grows Development Pipeline by 8% and System Size by 4%

- Board Increases Share Repurchase Authorization by $400 Million

Wyndham Hotels & Resorts (NYSE: WH) today announced results for the three months ended March 31, 2024.

Highlights include:

• Global RevPAR grew 1% in constant currency and ancillary revenues grew 8% compared to first quarter 2023.

• System-wide rooms grew 4% year-over-year.

• Opened over 13,000 rooms, representing a year-over-year increase of 27%.

• Awarded 171 development contracts, an increase of 8% year-over-year.

• Development pipeline grew 1% sequentially and 8% year-over-year to a record 243,000 rooms.

• Entered upscale extended stay segment through a strategic relationship with WaterWalk Extended Stay by Wyndham.

• Net cash provided by operating activities of $76 million and adjusted free cash flow of $102 million.

• Returned $89 million to shareholders through $57 million of share repurchases and quarterly cash dividends of $0.38 per share.

“We’re thrilled to announce another strong quarter of progress in our executions, openings, franchisee retention and net room growth around the world,” said Geoff Ballotti, president and chief executive officer.

“Increased interest from hotel owners in our brands has propelled our development pipeline to a record 243,000 rooms, marking an impressive 8% increase. Our strong balance sheet and cash flow generation capabilities provide significant opportunity to continue to enhance returns to our shareholders over both the short and long-term, as evidenced by our Board of Directors’ approval of a $400 million increase in our share repurchase authorization.”

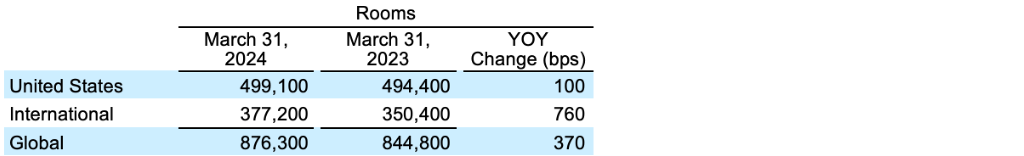

System Size and Development

The Company’s global system grew 4%, reflecting 1% growth in the U.S. and 8% internationally. The Company’s global system grew 4%, reflecting 1% growth in the U.S. and 8% internationally.

As expected, these increases included strong growth in both the higher RevPAR midscale and above segments in the U.S. and the direct franchising business in China, which grew 3% and 13%, respectively.

The Company remains solidly on track to achieve its net room growth outlook of 3 to 4% for the full year 2024, including an increase in its retention rate compared to 2023.

On March 31, 2024, the Company’s global development pipeline consisted of nearly 2,000 hotels and approximately 243,000 rooms, representing another record-high level and an 8% year-over-year increase. Key highlights include:

• 15th consecutive quarter of sequential pipeline growth

• 5% growth in the U.S. and 9% internationally

• Approximately 69% of the pipeline is in the midscale and above segments, which grew 4% year-over-year

• Approximately 58% of the pipeline is international

• Approximately 79% of the pipeline is new construction, of which approximately 35% has broken ground

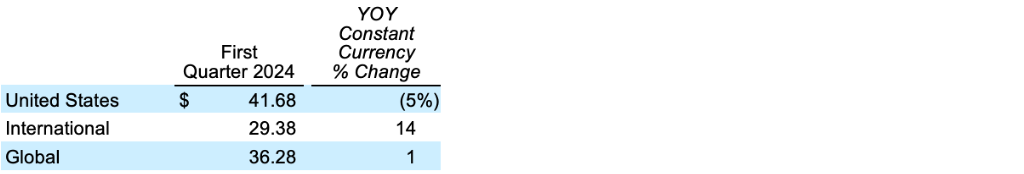

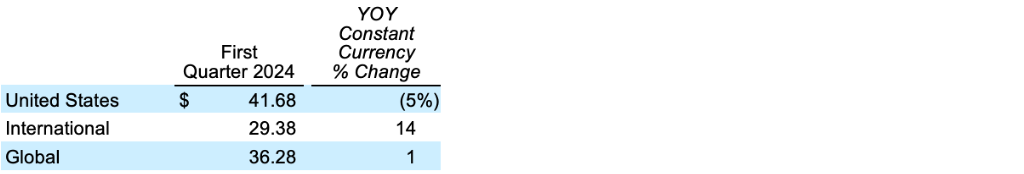

RevPAR

First quarter global RevPAR increased 1% in constant currency compared to 2023, reflecting a 5% decline in the U.S. and growth of 14% internationally.

In the U.S., the Company lapped the most difficult year-over-year comparisons during the first quarter, resulting in a decline of 440 basis points in occupancy and 50 basis points in ADR.

Notably, the Company saw improving trends in March with RevPAR improving 240 basis points compared to February. This improvement marks a significant pivot toward growth, preceding the peak leisure travel season.

Internationally, the Company generated year-over-year RevPAR growth for the first quarter in all regions primarily driven by continued pricing power, with ADR up 12% and occupancy up 2%.

The largest contributors to first quarter growth were our Latin America and EMEA regions.

First Quarter Operating Results

• Fee-related and other revenues were $304 million compared to $308 million in first quarter 2023, reflecting a decline of $5 million in royalty and franchise fees, partially offset by an 8% increase in ancillary revenue streams. The decline in royalties and franchise fees was primarily driven by the decline in U.S. RevPAR and the lapping of our highest quarter of other franchise fees, partially offset by global net room growth and higher international RevPAR.

• The Company generated net income of $16 million compared to $67 million in first quarter 2023. The decrease primarily reflects transaction-related expenses resulting from the unsuccessful hostile takeover attempt by Choice Hotels, an impairment charge primarily related to development advance notes and higher interest expense.

• Adjusted EBITDA was $141 million compared to $147 million in first quarter 2023. This decrease included a $10 million unfavorable impact from marketing fund variability, excluding which adjusted EBITDA grew 3% primarily reflecting favorable timing of expenses to better match revenue seasonality.

• Diluted earnings per share was $0.19 compared to $0.77 in first quarter 2023. This decrease reflects lower net income, partially offset by the benefit of a lower share count due to share repurchase activity.

• Adjusted diluted EPS was $0.78 compared to $0.86 in first quarter 2023. This decrease included $0.09 per share related to expected marketing fund variability (after estimated taxes). On a comparable basis, adjusted diluted EPS increased 1% year-over-year as comparable adjusted EBITDA growth and the benefit of share repurchase activity were largely offset by higher interest expense.

• During first quarter 2024, the Company’s marketing fund expenses exceeded revenues by $14 million, in line with expectations; while in first quarter 2023, the Company’s marketing fund expenses exceeded revenues by $4 million, resulting in $10 million of marketing fund variability. The Company continues to expect marketing fund revenues to equal expenses during full-year 2024.Full reconciliations of GAAP results to the Company’s non-GAAP adjusted measures for all reported periods appear in the tables to this press release.

Balance Sheet and Liquidity

The Company generated $76 million of net cash provided by operating activities and adjusted free cash flow of $102 million in first quarter 2024. The Company ended the quarter with a cash balance of $50 million and over $580 million in total liquidity.

The Company’s net debt leverage ratio was 3.4 times at March 31, 2024, within the lower half of the Company’s 3 to 4 times stated target range.

During the first quarter of 2024, the Company executed $275 million of new forward starting interest rate swaps on its Term Loan B Facility, which will begin in fourth quarter 2024 and expire in 2027.

The fixed rate of the new swaps is 3.4%. As a result, nearly all the Company’s Term Loan B Facility now has a fixed rate through the end of 2027.

Share Repurchases and Dividends

During the first quarter, the Company repurchased approximately 719,000 shares of its common stock for $57 million. The Company’s Board of Directors recently increased the Company’s share repurchase authorization by $400 million.

The Company paid common stock dividends of $32 million, or $0.38 per share, during first quarter 2024.

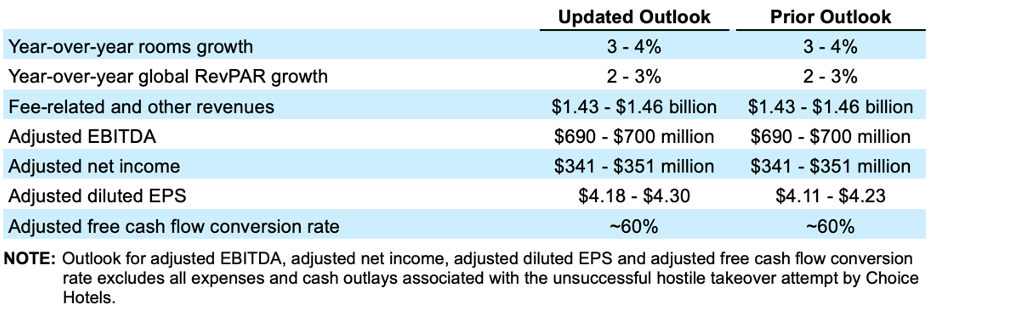

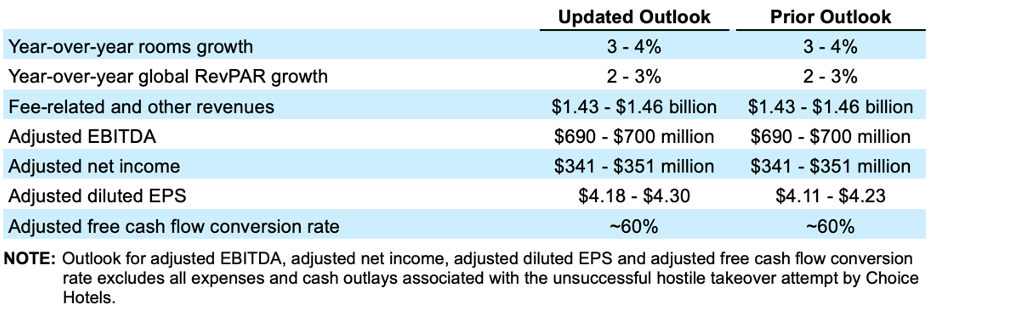

Full-Year 2024 Outlook

The Company is updating its outlook as follows to reflect the impact of first quarter share repurchase activity:

Year-over-year growth rates for adjusted EBITDA, adjusted net income and adjusted diluted EPS are not comparable due to full-year 2023 marketing fund revenues exceeding expenses by $9 million, which substantially completed the recovery of the $49 million support the Company provided to its owners during COVID. Year-over-year growth rates for adjusted EBITDA, adjusted net income and adjusted diluted EPS are not comparable due to full-year 2023 marketing fund revenues exceeding expenses by $9 million, which substantially completed the recovery of the $49 million support the Company provided to its owners during COVID.

The Company continues to expect marketing fund revenues to equal expenses during full-year 2024 though seasonality of spend will affect the quarterly comparisons throughout the year.

More detailed projections are available in Table 8 of this press release.

The Company is providing certain financial metrics only on a non-GAAP basis because, without unreasonable efforts, it is unable to predict with reasonable certainty the occurrence or amount of all of the adjustments or other potential adjustments that may arise in the future during the forward-looking period, which can be dependent on future events that may not be reliably predicted.

Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to the reported results.

Conference Call Information

Wyndham Hotels will hold a conference call with investors to discuss the Company’s results and outlook on Thursday, April 25, 2024 at 8:30 a.m. ET.

Listeners can access the webcast live through the Company’s website at https://investor.wyndhamhotels.com.

The conference call may also be accessed by dialing 800 225-9448 and providing the passcode “Wyndham”. Listeners are urged to call at least five minutes prior to the scheduled start time.

An archive of this webcast will be available on the website beginning at noon ET on April 25, 2024. A telephone replay will be available for approximately ten days beginning at noon ET on April 25, 2024 at 800 839-8531.

Presentation of Financial Information

Financial information discussed in this press release includes non-GAAP measures, which include or exclude certain items.

These non-GAAP measures differ from reported GAAP results and are intended to illustrate what management believes are relevant period-over-period comparisons and are helpful to investors as an additional tool for further understanding and assessing the Company’s ongoing operating performance.

The Company uses these measures internally to assess its operating performance, both absolutely and in comparison to other companies, and to make day to day operating decisions, including in the evaluation of selected compensation decisions.

Exclusion of items in the Company’s non-GAAP presentation should not be considered an inference that these items are unusual, infrequent or non-recurring.

Full reconciliations of GAAP results to the comparable non-GAAP measures for the reported periods appear in the financial tables section of this press release.

About Wyndham Hotels & Resorts

Wyndham Hotels & Resorts (NYSE: WH) is the world’s largest hotel franchising company by the number of properties, with approximately 9,200 hotels across over 95 countries on six continents. Through its network of over 876,000 rooms appealing to the everyday traveler, Wyndham commands a leading presence in the economy and midscale segments of the lodging industry. The Company operates a portfolio of 25 hotel brands, including Super 8, Days Inn, Ramada, Microtel, La Quinta, Baymont, Wingate, AmericInn, Hawthorn Suites, Trademark Collection and Wyndham. The Company’s award-winning Wyndham Rewards loyalty program offers approximately 108 million enrolled members the opportunity to redeem points at thousands of hotels, vacation club resorts and vacation rentals globally. Accordingly, investors should monitor this section of the Company’s website and the Company’s social media channels in addition to following the Company’s press releases, filings submitted with the Securities and Exchange Commission and any public conference calls or webcasts.

|

|